Loading

Get F4868

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the F4868 online

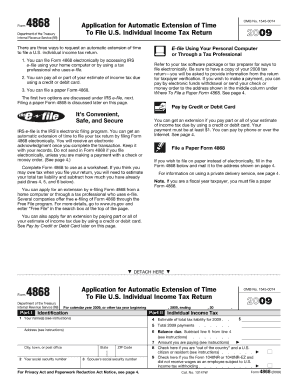

The F4868 form is an essential document for those seeking to request an automatic extension of time to file their federal income tax return. This guide provides a clear, step-by-step approach to completing the form online, ensuring that users have all the necessary information at their fingertips.

Follow the steps to effectively complete your F4868 form online.

- Click the ‘Get Form’ button to access the F4868 form and open it in your preferred editor.

- Begin by entering your personal information in the fields provided. This typically includes your name, address, and Social Security number. Ensure that all entries are accurate to avoid processing delays.

- Next, indicate your expected filing status. This can affect the amount of tax you owe, so choose carefully from the options available.

- In the section for payment, detail any payment you are making for your anticipated tax liability. If you are not making a payment, you can leave this section blank.

- Review all information entered to ensure it is correct. Check for any potential errors that could affect your extension request.

- Once satisfied with the completed form, you will have options to save changes, download, print, or share the form as needed.

Complete your F4868 form online today for a seamless tax extension process.

Those residing in federally declared disaster areas typically qualify for the automatic 2 month extension. Additionally, active-duty military personnel are also eligible in certain situations. This extension serves to provide flexibility for those facing unique challenges during tax season.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.