Loading

Get F4868 Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the F4868 Forms online

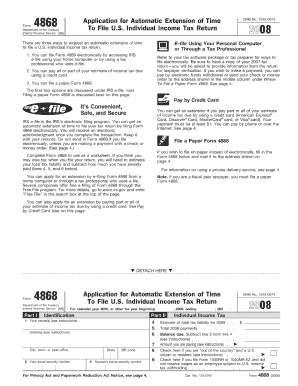

Filling out the F4868 Forms online is a straightforward process that allows users to request an extension for filing their individual income tax return. This guide serves as a step-by-step resource, ensuring that you can complete the form accurately and efficiently.

Follow the steps to successfully complete the F4868 Forms online.

- Click ‘Get Form’ button to obtain the form and open it in your document management system.

- Begin by entering your personal information in the appropriate fields, including your name, address, and social security number. Ensure that all details are accurate to avoid delays.

- In the section for tax year, specify the year for which you are requesting an extension. This is crucial for ensuring that your request is processed correctly.

- Indicate your estimated tax liability. This information helps determine your eligibility for the extension and any potential penalties for underpayment.

- Review the payment amount, if applicable, for any taxes owed. You may need to make a payment to avoid penalties.

- After filling in all the necessary fields, take a moment to review your entries for accuracy. Double-check all figures and personal information.

- Once satisfied with the completion of the form, you can save changes, download a copy for your records, print the document, or share it as needed.

Take action now and complete your F4868 Forms online to ensure timely processing!

Related links form

No, you do not need to provide a reason to file your F4868 Forms; you can request an extension for any reason. The IRS allows individuals to file this extension regardless of their circumstances, so you can take the time needed to prepare your tax return. If you have further questions on this topic, uslegalforms can offer valuable insights and resources for navigating your extension filing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.