Loading

Get Md W-4 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD W-4 online

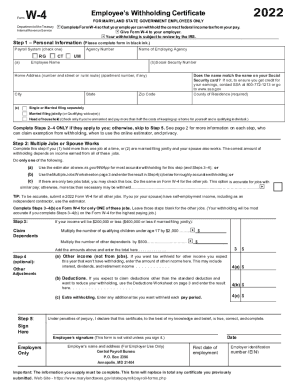

Filling out the MD W-4 form is an important step for Maryland state government employees to ensure accurate tax withholding from their pay. This guide will provide you with clear, step-by-step instructions to help you complete the form online with confidence.

Follow the steps to complete the MD W-4 form online effectively.

- Click 'Get Form' button to acquire the MD W-4 and open it in your preferred editor.

- Begin by entering your personal information. Fill in the payroll system, agency number, employee name, and social security number accurately. Provide your home address, including city, state, and zip code. Ensure that the name matches your Social Security card to avoid issues.

- Select your filing status by checking one box. Options include 'Single or married filing separately,' 'Married filing jointly,' or 'Head of household.' Only check the head of household option if you meet the criteria.

- If applicable, complete Steps 2-4. Step 2 addresses multiple jobs or if your spouse works. Select either the online estimator, complete the Multiple Jobs Worksheet, or check the box if only two jobs are held with similar pay.

- In Step 3, claim your dependents. If your income qualifies, calculate the amount for qualifying children and other dependents, then sum these amounts and enter the total.

- Step 4 allows for optional adjustments. Enter any other income that will not have withholding, and specify any deductions or extra withholding amounts if applicable.

- Lastly, sign the form in Step 5, confirming that the information provided is accurate. Enter the date of signing and ensure your form is complete before submission.

Complete your MD W-4 form online today to ensure proper withholding for your earnings.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Maryland income tax withholding Maryland's income tax rate ranges from 2% to 5.75%, based on the employee's income and filing status with some exceptions for retirees. Employees who receive Social Security benefits, for instance, are exempt from taxation.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.