Get Form K 40pt 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form K 40pt 2009 online

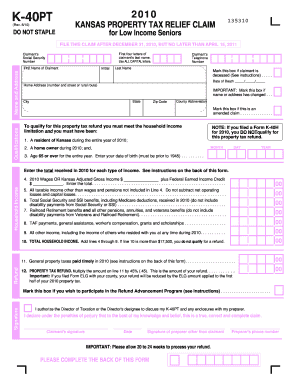

Filling out the Form K 40pt 2009 online can simplify the process of claiming property tax relief for low income seniors. This guide will provide you with a clear, step-by-step approach to complete each section of the form accurately.

Follow the steps to complete the Form K 40pt 2009 online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Start by entering the claimant's name and address. Include the first name, last name (in all capital letters), and telephone number. If applicable, mark the box if the claimant is deceased and provide the date of death.

- Indicate any changes to the name or address by marking the appropriate box. If this is an amended claim, mark that box as well.

- Provide the date of birth of the claimant, ensuring it is before 1945, and confirm the residency in Kansas during 2010 and home ownership for that year.

- Fill in the total household income on Line 10 by adding the income from various sources as prompted in the form, ensuring you adhere to the income limitations.

- Document the general property taxes paid in 2010 on Line 11, and then calculate the property tax refund by multiplying this amount by 45% on Line 12.

- Complete the signature section, where the claimant must sign and date the form. If another preparer assisted, that person must also provide their signature.

- Finally, review all entries for accuracy, save your changes, and choose to download, print, or share the completed form as needed.

Complete your Form K 40pt 2009 online today to ensure your property tax relief claim is submitted on time.

Related links form

To obtain a Schedule K form, taxpayers can download it from the Kansas Department of Revenue website or access resources from uslegalforms. The Schedule K is often issued by partnerships and S corporations to report income that is then passed through to individual tax returns. Ensure that you have the correct year’s form, like the Form K 40pt 2009, to maintain accurate records. By using reliable legal platforms, you simplify the process of acquiring necessary tax forms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.