Loading

Get Vat Declaration Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Vat Declaration Form online

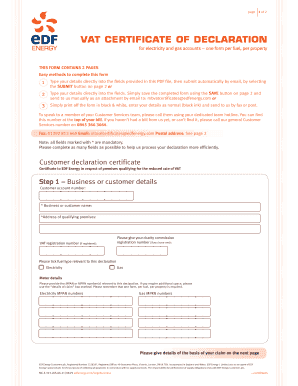

Filling out the Vat Declaration Form online is a straightforward process that allows users to declare their eligibility for reduced VAT rates on electricity and gas accounts. This guide provides step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete your Vat Declaration Form online

- Press the ‘Get Form’ button to obtain the Vat Declaration Form and open it in your preferred PDF editor.

- Begin by entering the customer account number and the name of the business or individual submitting the form in the designated fields. Ensure you include the full address of the qualifying premises.

- If applicable, provide your VAT registration number. If you are representing a charity, include your charity commission registration number.

- Indicate the type of fuel relevant to your declaration by checking the box next to ‘Electricity’ or ‘Gas’. You will need to provide the MPAN or MPRN numbers corresponding to the chosen fuel type.

- Next, move to the details of your claim. Specify the percentage of total consumption qualifying for the reduced VAT rate as a whole number.

- Select the reason for your claim by checking the appropriate box: Domestic use, Charitable non-business use, or specify the combined use if applicable. Be sure to provide the necessary details supporting your claim.

- In the customer declaration section, confirm that the information provided is correct by ticking the corresponding box. Users filling out the form electronically should note that signatures may be required later.

- Finally, save your changes using the ‘SAVE’ button, then you can choose to either send the form manually via email or submit it electronically using the ‘SUBMIT’ button.

Complete your Vat Declaration Form online today to ensure accurate and efficient processing of your VAT claims.

Filing VAT step-by-step begins with organizing your financial documents. Calculate your output and input VAT based on your records, and fill in the VAT declaration form. Finally, ensure you submit this form on time to stay compliant with tax regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.