Loading

Get Www.pema.pa.govgrantshmgprealty Transfer Tax Statement Of Value (rev-183)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

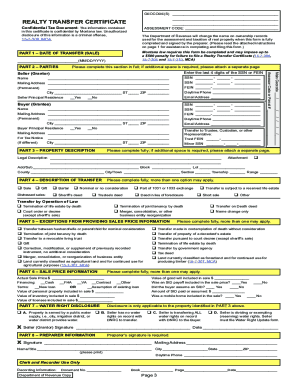

How to use or fill out the Www.pema.pa.govGrantsHMGPRealty Transfer Tax Statement Of Value (REV-183) online

This guide provides comprehensive instructions on how to complete the Realty Transfer Tax Statement of Value (REV-183) online. Whether you are familiar with online forms or this is your first time, this guide will walk you through each section with clarity and ease.

Follow the steps to effectively complete the form.

- Click ‘Get Form’ button to access the form and open it in the editor for online completion.

- In Part 1, enter the date of transfer (sale) in the proper format (MM/DD/YYYY) as specified in the form.

- Move to Part 2 and input the names of the Seller (Grantor) and Buyer (Grantee) as they appear on the real estate deed. Include mailing addresses and indicate whether these are their principal residences.

- In Part 3, provide a complete legal description of the property being transferred. You may check the box if you are attaching this information.

- For Part 4, check the appropriate boxes that describe the transfer type. Ensure to supply any necessary documentation if the transfer involves legal proceedings or other conditions.

- If any exceptions apply in Part 5, check the appropriate box and skip Part 6. If none apply, complete Part 6 by entering the actual sale price, financing details, and values related to any included personal property.

- In Part 7, complete the Water Rights Disclosure based on the applicable condition of the property. Supply any necessary details regarding water rights.

- Finally, in Part 8, the preparer must sign and date the document, affirming the accuracy of the information within. Ensure all required fields are complete before proceeding.

- After completing the form, you can save changes, download, print the form, or share it as needed for filing.

Complete your Realty Transfer Tax Statement of Value form online today for a seamless filing experience.

The state realty transfer tax is 1% of the total computed value.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.