Loading

Get 14 Printable 2016 Form 990 Templates - Fillable Samples In ...

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 14 Printable 2016 Form 990 Templates - Fillable Samples online

Filling out the 2016 Form 990 templates can be a straightforward process when you have clear guidance. This guide provides step-by-step instructions to help you complete the necessary sections accurately and efficiently.

Follow the steps to complete your form accurately.

- Click ‘Get Form’ button to acquire the form and open it in your preferred editor.

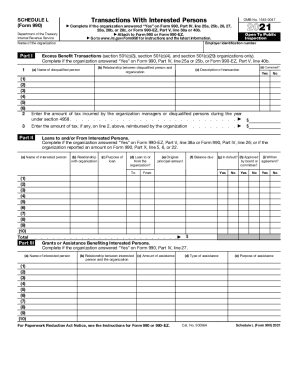

- Begin by entering the name of the disqualified person in Part I, line 1. Ensure you check if the organization has answered 'Yes' to the relevant questions in Form 990, Part IV.

- In the next fields, specify the relationship between the disqualified person and the organization as per point (b). Clearly describe the transaction in point (c).

- For any excess benefit transactions, indicate whether the transaction has been corrected in the field d.

- Proceed to Part II where you will document any loans made to or from interested persons. Fill out names, amounts, balances, and details regarding loan status in the provided fields.

- Next, complete Part III concerning grants or assistance benefiting interested persons by listing their names, relationships, and assisting details.

- In Part IV, record any business transactions involving interested persons. Ensure to fill out all required fields accurately, reflecting relationships and transaction amounts.

- Finally, utilize Part V to provide any supplemental information needed to clarify responses on Schedule L. Be thorough and concise in your explanations.

- Once completed, review all entries for accuracy. Save your changes, and if necessary, download, print, or share your form as required.

Start completing your Form 990 templates online today for efficient document management.

If an organization has gross receipts less than $200,000 and total assets at the end of the year less than $500,000, it can file Form 990-EZ, instead of Form 990.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.