Get Irs 8915-c 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8915-C online

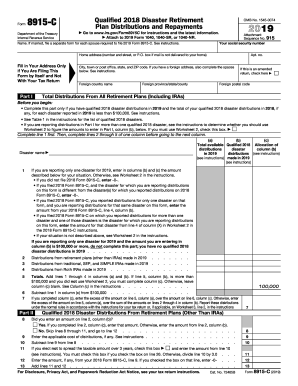

The IRS 8915-C form is used to report qualified disaster retirement plan distributions and repayments, specifically for disasters that occurred in 2018. This guide provides a clear, step-by-step process to assist users in filling out this form online.

Follow the steps to complete the IRS 8915-C form effectively.

- Press ‘Get Form’ button to access the IRS 8915-C form and open it in your preferred online editor.

- Begin by entering your name and social security number at the top of the form. If you are married, ensure each spouse files a separate form.

- Fill in your complete home address. If this form is being filed independently and not with your tax return, only then complete this section.

- In Part I, check the box if you are reporting distributions for more than one qualified 2018 disaster and determine if you need to use Worksheet 2 for calculations.

- Enter total distributions from all retirement plans, including IRAs, in the designated columns under Part I, first completing line 1.

- Calculate the totals across each column as prompted by the form and follow the instructions for entries specific to your situation.

- Proceed to Part II to report qualified disaster distributions from retirement plans other than IRAs, ensuring that each appropriate amount is entered.

- Continue through Parts III and IV as applicable, answering questions and entering amounts related to your distributions or repayments.

- Finally, review the entire form for accuracy. Users can then save changes, download, print, or share the form as needed.

Complete your IRS 8915-C form online today to ensure accurate reporting of your disaster-related distributions.

To obtain a 147C letter from the IRS online, you first need to access the IRS website and follow the prompts for getting a transcript or verification letter. Ensure you have your information ready, including your business name and Employer Identification Number. After verifying your identity, you will be able to request the letter directly through the portal. The US Legal Forms platform also offers resources to guide you through this process seamlessly, offering clarity on handling IRS documents.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.