Loading

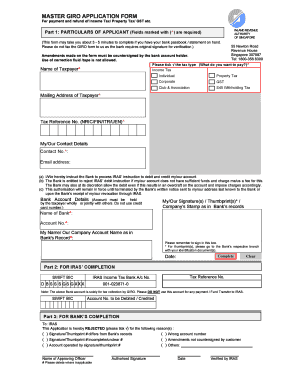

Get Iras Gst Giro Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Iras Gst Giro Form online

This guide provides clear and detailed instructions for completing the Iras Gst Giro Form online. With a professional tone, we aim to ensure that users, regardless of their experience level, can navigate the form efficiently.

Follow the steps to fill out the form accurately.

- Click ‘Get Form’ button to acquire the Iras Gst Giro Form and open it for editing.

- Complete Part 1: Particulars of Applicant. Please fill in the required fields, including your tax reference number and mailing address. Ensure you tick the applicable tax types such as income tax, property tax, or GST.

- Provide your contact details. Enter your phone numbers and email address in the designated fields. This information is crucial for communication and verification.

- Fill in your bank account details. Ensure that the account is held by you or in joint ownership. Enter the bank name, account number, and your name as per the bank's records. Remember to sign in the appropriate box.

- Review the authorisation statement regarding the bank's ability to process your instructions. Understand that the bank may reject any debit instructions if your account does not have sufficient funds.

- Complete the date and ensure you have signed or thumbprinted as required. For thumbprints, visit the bank’s branch with identification for verification.

- Ensure that no corrections are made using correction fluid or tape and that any amendments are countersigned by the bank account holder.

- After completing the form, save changes, and consider downloading or printing it. Ensure all information is correct before sharing or submitting it as required.

Complete your forms online for a streamlined process.

Changing your GIRO account requires you to complete a new Iras Gst Giro Form. Start by filling out the updated details of your new account, then submit the form to your bank for processing. This change will ensure that future payments are deducted from your new account without interruption.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.