Loading

Get Realpropertyhonolulu

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Realpropertyhonolulu online

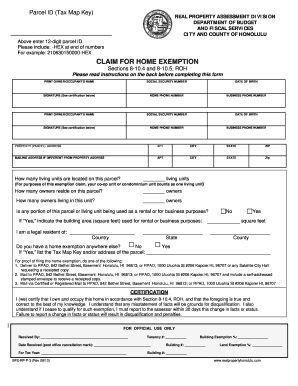

Filling out the Realpropertyhonolulu form online is a necessary step for individuals claiming a home exemption in Honolulu. This guide will walk you through each section of the form, ensuring you provide all needed information accurately and efficiently.

Follow the steps to successfully complete the Realpropertyhonolulu form online.

- Press the ‘Get Form’ button to access the Realpropertyhonolulu form online and open it in your preferred document editor.

- Begin by entering the 12-digit parcel ID in the designated field. Make sure to follow the example format by including '-HEX' at the end of the numbers.

- In the 'Claim for home exemption' section, carefully input the print owner's or occupant's name, Social Security number, and date of birth.

- You will be required to provide a signature in the specified area, acknowledging the certification statement provided.

- Next, enter the home and business phone numbers for the owner or occupant.

- Complete the section for the property address, including any apartment number, city, state, and ZIP code.

- If your mailing address is different, please provide that information in the corresponding fields.

- Indicate the number of living units located on the parcel, noting that co-op or condominium units count as one living unit.

- Report the number of owners who reside on this parcel and the number of owners living in the unit.

- Answer whether any part of the parcel or living unit is used for rental or business purposes and provide the square footage if applicable.

- Confirm your legal residency by filling in the country, state, and county of residence.

- If you have a home exemption in another location, indicate 'Yes' and provide the Tax Map Key and/or address of that parcel.

- To prove your filing for the home exemption, choose one of the delivery methods outlined for submitting supporting documents.

- Finally, review all entered details for accuracy, then proceed to save changes, download, print, or share your completed form.

Start your online process today to complete and submit your Realpropertyhonolulu form.

Related links form

To claim a home exemption in Hawaii, you must complete an application form detailing your property. Submit this application to your county's tax office, ensuring that all required documents accompany it. Stay informed about eligibility criteria and updates by exploring Realpropertyhonolulu for relevant information.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.