Get Nr 6 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nr 6 Form online

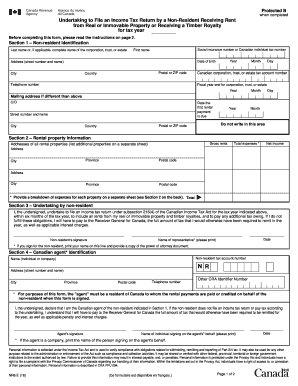

Filling out the Nr 6 Form online is a vital step for non-residents receiving rent from real property or timber royalties. This guide provides a clear, step-by-step process to help users complete the form accurately and confidently.

Follow the steps to effectively complete the Nr 6 Form online.

- Click ‘Get Form’ button to acquire the Nr 6 Form and open it for editing.

- Begin with Section 1 – Non-resident identification. Input your last name or the full name of the corporation, trust, or estate. Then, provide your social insurance number or Canadian individual tax number, first name, and date of birth. Fill in your complete address, including street name and number, city, postal or ZIP code, and country. If applicable, include the Canadian corporation, trust, or estate tax account number and fiscal year end.

- In Section 2 – Rental property information, list all addresses of rental properties along with the total gross rents. Enumerate total expenses and calculate net income for each property. If necessary, attach a separate sheet detailing the expenses for clarity.

- For Section 3 – Undertaking by non-resident, sign and date the document. If you are signing on behalf of the non-resident, print your name and attach a power of attorney document.

- In Section 4 – Canadian agent identification, provide the name and address of the agent, ensuring they are a resident of Canada. Enter the non-resident tax account number and any relevant CRA identifier numbers. Sign and date this section.

- Once all sections are filled correctly, save any changes made to the document. Download, print, or share the completed Nr 6 Form as required.

Complete your Nr 6 Form online today to ensure your tax obligations are managed effectively.

The completed T3010 form must be mailed to the appropriate Charities Directorate of the Canada Revenue Agency, as outlined in the form's instructions. Paying attention to the mailing instructions is essential to ensure proper handling and processing of your submitted form. By timely submitting your T3010 along with the NR 6 Form, you can stay compliant with your tax obligations. For more detailed guidance on these forms, consider exploring solutions at uslegalforms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.