Loading

Get Tillamook Transient Lodging County Tax Date Received - Co Tillamook Or

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Tillamook Transient Lodging County Tax Date Received - Co Tillamook Or online

Filling out the Tillamook Transient Lodging County Tax Date Received form online is a straightforward process. This guide provides a step-by-step approach to assist users in completing the form accurately and efficiently.

Follow the steps to complete the form online:

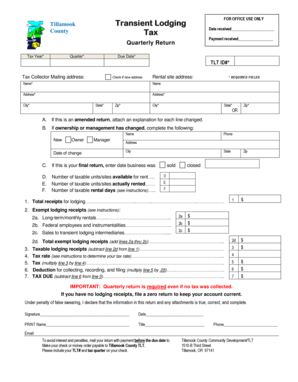

- Click ‘Get Form’ button to access the Tillamook Transient Lodging County Tax Date Received form and open it in the editor.

- Begin by entering the date the form is being submitted in the 'Date received' field.

- Provide the payment received date in the corresponding field.

- Indicate the tax year and quarter for the filing period.

- Fill in your TLT ID number and check the box if this is a new address.

- Enter the mailing address of the tax collector as specified in the form.

- Fill out the rental site address accurately.

- Complete the 'Name' field with the appropriate person or business name.

- Provide the necessary address, city, state, and zip code details.

- If applicable, indicate if this is an amended return and attach an explanation for any changes.

- If there has been a change in ownership or management, fill in the new owner's or manager's name, date of change, and contact information.

- If filing your final return, include the date the business was sold or closed.

- Enter the number of taxable units or sites available for rent and the actual number rented.

- State the number of taxable rental days based on the provided instructions.

- Calculate total exempt lodging receipts and taxable lodging receipts, making sure to follow the instructions for each line.

- Determine the tax rate and calculate the tax amount based on the taxable lodging receipts.

- Apply the deduction for collecting and filing as specified.

- Calculate the total tax due by subtracting the deduction from the tax amount.

- Finally, sign and date the form, and provide your printed name and title.

- Save your changes, and ensure you have a downloadable or printable copy for your records.

Complete your Tillamook Transient Lodging County Tax date received form online today!

A "Yes" vote will establish a nine and one-half percent (9.5%) tax to be levied on the gross rent charged for the occupancy of transient lodging in Reedsport.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.