Get Fincen Form 114a 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign FinCen Form 114a online

How to fill out and sign FinCen Form 114a online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If the tax duration commenced unexpectedly or perhaps you just overlooked it, it might likely lead to issues for you. FinCen Form 114a isn't the simplest one, but you have no cause for concern in any circumstance.

With our ultimate solution, you will discover how to complete FinCen Form 114a even in circumstances of severe time constraints. You merely need to adhere to these straightforward recommendations:

With our comprehensive digital solution and its beneficial tools, filling out FinCen Form 114a becomes more manageable. Don't hesitate to try it and allocate more time for leisure activities instead of document preparation.

Access the document using our sophisticated PDF editor.

Complete the information required in FinCen Form 114a by utilizing fillable fields.

Insert images, checks, tick boxes, and text boxes, if applicable.

Repeated details will be populated automatically after the initial entry.

If you encounter any issues, utilize the Wizard Tool. You will receive some guidance for easier submission.

Remember to include the application date.

Create your exclusive electronic signature once and place it in all necessary fields.

Verify the information you have input. Amend errors if necessary.

Hit Done to complete modifications and select how you will submit it. You can opt for digital fax, USPS, or email.

You can also download the document to print it later or upload it to cloud storage.

How to Modify Get FinCen Form 114a 2015: Personalize Documents Online

Authorize and disseminate Get FinCen Form 114a 2015 along with any other commercial and personal paperwork online without squandering time and resources on printing and mailing. Maximize our web-based document editor which includes a built-in compliant electronic signature feature.

Signing and submitting Get FinCen Form 114a 2015 documents electronically is quicker and more effective than handling them on paper. However, it necessitates using online solutions that ensure a high level of data security and furnish you with a compliant tool for creating electronic signatures. Our powerful online editor is precisely what you need to prepare your Get FinCen Form 114a 2015 and other personal and corporate or tax documents accurately and suitably according to all standards. It provides all the critical tools to easily and swiftly complete, alter, and sign documents online and add Signature fields for others, indicating who and where they should sign.

It only takes a few straightforward steps to complete and sign Get FinCen Form 114a 2015 online:

When authorizing Get FinCen Form 114a 2015 with our comprehensive online solution, you can always be confident that it will be legally binding and acceptable in court. Prepare and submit documents in the most efficient manner possible!

- Open the selected file for further editing.

- Utilize the upper toolbar to incorporate Text, Initials, Image, Check, and Cross marks to your sample.

- Highlight the significant information and obscure or eliminate the sensitive details if necessary.

- Click on the Sign option above and select how you wish to eSign your document.

- Draw your signature, type it, upload its image, or opt for another suitable method.

- Proceed to the Edit Fillable Fields panel and position Signature areas for others.

- Click on Add Signer and input your recipient’s email to assign this field to them.

- Confirm that all provided information is thorough and precise before you click Done.

- Distribute your paperwork with others using one of the available options.

Related links form

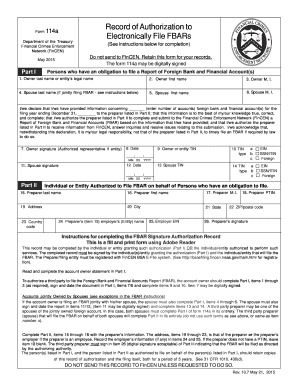

Individuals and entities with foreign bank accounts that meet or exceed $10,000 in total value are required to file the FinCEN Form 114. This includes U.S. citizens, residents, and certain businesses. Failing to file correctly can result in significant penalties, so it is essential to ensure you meet these requirements.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.