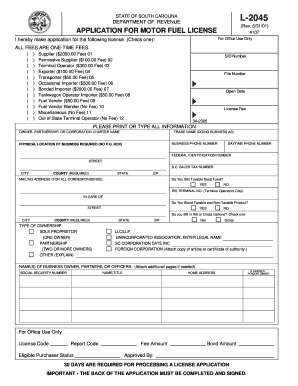

Get Sc Dor L-2045 2001

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign SC DoR L-2045 online

How to fill out and sign SC DoR L-2045 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Filling out tax forms can become a significant barrier and major concern if adequate assistance is not provided. US Legal Forms has been developed as an online solution for SC DoR L-2045 e-filing and offers numerous benefits to taxpayers.

Utilize the instructions on how to complete the SC DoR L-2045:

Click the Done button in the top menu once you have finished. Save, download, or export the completed form. Use US Legal Forms to ensure secure and convenient SC DoR L-2045 completion.

- Locate the form on the website within the specific category or by using the search engine.

- Click the orange button to access it and wait for it to load.

- Review the document and pay attention to the instructions. If you have never filled out the form before, follow the step-by-step directions.

- Focus on the highlighted fields. They are editable and require specific information to be entered. If you are unsure what details to provide, refer to the guidelines.

- Always sign the SC DoR L-2045. Use the built-in tool to create your electronic signature.

- Select the date field to automatically insert the current date.

- Proofread the document to make any necessary changes before submitting.

How to modify Get SC DoR L-2045 2001: personalize forms online

Streamline your document preparation journey and tailor it to your specifications with just a few clicks. Complete and authorize Get SC DoR L-2045 2001 using a powerful yet user-friendly online editor.

Drafting documentation can be a hassle, especially when you tackle it occasionally. It requires you to meticulously adhere to all the procedures and precisely fill in all sections with complete and accurate information. However, it's common to need to revise the document or add additional sections to complete. If you wish to enhance Get SC DoR L-2045 2001 before submitting, the easiest approach is to leverage our all-inclusive yet straightforward online editing solutions.

This broad PDF editing platform allows you to swiftly and effortlessly finalize legal documents from any device with internet access, perform basic modifications to the template, and add more fillable sections. The tool enables you to select a specific field for each type of information required, like Name, Signature, Currency, and SSN, among others. You can designate them as mandatory or conditional and decide who needs to fill out each field by assigning them to a specified recipient.

Follow the instructions below to enhance your Get SC DoR L-2045 2001 online:

Our editor is a versatile, feature-rich online solution that can assist you in swiftly and effortlessly enhancing Get SC DoR L-2045 2001 and other forms based on your preferences. Decrease document preparation and submission duration while ensuring your forms appear professional without any complications.

- Access the necessary template from the directory.

- Complete the fields with Text and utilize Check and Cross tools on the checkboxes.

- Employ the right-hand toolbar to modify the form with newly fillable areas.

- Choose the sections in accordance with the type of information you wish to gather.

- Designate these fields as mandatory, optional, or conditional and adjust their sequence.

- Allocate each field to a specific party using the Add Signer feature.

- Verify that all necessary changes have been made and click Done.

Get form

To obtain a South Carolina sales tax exemption certificate, you need to fill out the appropriate forms provided by the SC Department of Revenue. The SC DoR L-2045 gives detailed instructions on the required documentation and procedures. This tool helps streamline your application process for tax exemptions.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.