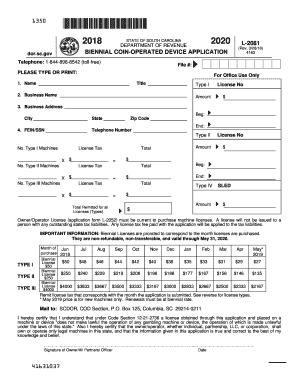

Get Sc Dor L-2081 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR L-2081 online

Filling out the SC DoR L-2081, a vital form for the biennial coin-operated device application, is an essential task for ensuring compliance with South Carolina’s regulations. This guide will provide you with detailed, step-by-step instructions for completing this form online effectively.

Follow the steps to complete your SC DoR L-2081 application online.

- Press the ‘Get Form’ button to access the SC DoR L-2081 and open it in your editing interface.

- Begin filling out the form by entering your name and title in the designated fields. Make sure your input is clear and legible.

- Input your business name in the corresponding field. This is crucial for ensuring that your application is properly associated with your business.

- Enter your business address, including the starting address and city. Be thorough to avoid delays in processing.

- Provide the state and zip code for your business address to finalize this section.

- In the FEIN/SSN field, input your Federal Employer Identification Number or Social Security Number as required for identification.

- Enter your telephone number in the designated section to ensure you can be reached regarding your application.

- Indicate the number of Type I and Type II machines you are applying for along with the corresponding license tax fees as outlined in the form.

- Complete sections for Type III and Type IV machines if applicable and calculate the total license tax due. Make sure all calculations are accurate.

- Affix your signature and the date in the required section, certifying the accuracy of the information provided and acknowledging your understanding of the associated regulations.

- After reviewing your entries for accuracy, save your changes, and proceed to download or print the form if necessary.

- Finally, submit your completed application by mailing it to the specified address, or choose to share it as required.

Complete your SC DoR L-2081 application online today for a smooth processing experience.

Get form

To contact South Carolina State Tax, you can visit their official website for various contact options, including phone numbers, email addresses, and live chat options. For inquiries specifically about SC DoR L-2081, using the designated phone line can ensure that your questions are answered promptly and accurately. Always have your tax information ready for the fastest service.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.