Get Irp Schedule C 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irp Schedule C online

The Irp Schedule C is an essential document for individuals and organizations involved in interstate commercial vehicle operations. This guide provides step-by-step instructions to enable users to complete the form efficiently and accurately in an online format.

Follow the steps to complete your Irp Schedule C online.

- Click ‘Get Form’ button to obtain the schedule and open it in your editor.

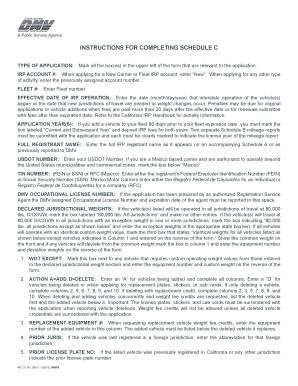

- In the upper left section of the form, mark all boxes that relate to the type of application you are submitting.

- Input your IRP account number. If you are a new carrier or fleet, write ‘New’. For other activities, enter your existing assigned account number.

- Enter your Fleet number in the designated field.

- Specify the effective date of IRP operation by entering the month, day, and year when you began interstate operations.

- Indicate the application year(s) applicable to your filing. If adding a vehicle within 60 days of expiration, select ‘Current and Subsequent Year’.

- Provide the full registrant name as indicated on your Schedule A or corresponding document.

- Enter your USDOT number and, if applicable, select the box for Mexico-based operations.

- For TIN number, include either your FEIN or SSN, or the RFC if applying from Mexico.

- Supply the DMV occupational license number if an authorized registration service agent prepared your application.

- Mark the declared jurisdictional weights related to your vehicle(s) and enter any necessary custom weights if applicable.

- Indicate whether you are adding or deleting vehicles, using the appropriate action codes: A for add, D for delete.

- List details for each vehicle, including equipment number, make, full vehicle identification number, body type, model year, and the number of axles.

- Complete the fees computation and calculations as required in sections for weight, registration, and other applicable fees.

- Review the entire document for accuracy, then save your changes, download, print, or share the completed form as needed.

Complete your Irp Schedule C online today to ensure compliance and streamline your vehicle registration process.

Schedule C outlines various items that a sole proprietor needs to report for tax purposes, such as income earned and expenses incurred during the year. You'll include business-related costs such as advertising, utilities, and vehicle expenses. Knowing what falls under Schedule C is vital for accurately reporting your finances and ensuring compliance. By utilizing tools from US Legal Forms, you can easily navigate the intricacies of the Irp Schedule C.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.