Loading

Get Vat 83

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Vat 83 online

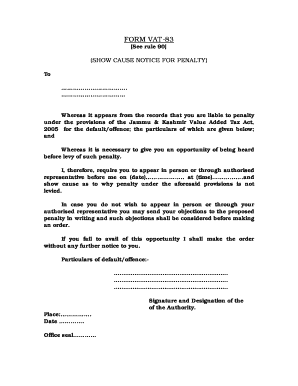

The Vat 83 form serves as a show cause notice for penalties associated with the Jammu & Kashmir Value Added Tax Act, 2005. This guide will walk you through the process of completing the form online, ensuring that you provide all necessary information accurately.

Follow the steps to complete the Vat 83 form online.

- Use the ‘Get Form’ button to access the Vat 83 form and open it in the designated editor.

- Begin filling out the recipient's information. This includes the name and address of the individual or entity to whom the notice is addressed.

- In the section labeled 'Particulars of default/offence,' provide clear details regarding the alleged default or offence that may warrant a penalty.

- Specify the date and time by which the recipient must appear, either personally or through an authorized representative, to explain their position regarding the penalty.

- Include a note encouraging the recipient to submit any written objections regarding the proposed penalty if they do not wish to appear in person.

- Finish off by signing and dating the form, adding your designation and office seal where required.

- Once you have completed all sections, you can save changes, download, print, or share the form as necessary.

Take the steps to complete your Vat 83 form online today.

VAT stands for value-added tax, a consumption tax levied on the value added to goods and services. It is charged at each stage of production and distribution, making it important for consumers and businesses alike. By utilizing Vat 83, you can streamline your VAT processes, ensuring compliance and accuracy in your financial reports.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.