Get Nj St7

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nj St7 online

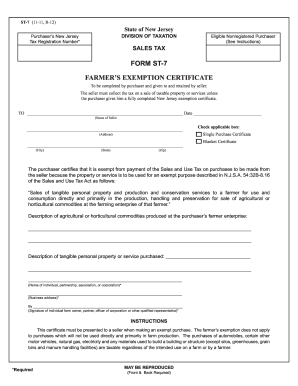

The Nj St7, also known as the Farmer's Exemption Certificate, is a crucial document for users in New Jersey who are involved in agricultural or horticultural enterprises. This guide provides comprehensive instructions on how to fill out this form online, ensuring users can easily obtain the necessary exemptions.

Follow the steps to complete the Nj St7 form online.

- Press the 'Get Form' button to access the Nj St7 form and open it in your chosen editor.

- Enter the name of the seller in the designated field at the top of the form. This is the individual or business from whom the exempt purchase will be made.

- Provide the seller's complete address, including city, state, and zip code, in the appropriate fields.

- Indicate whether this is a Single Purchase Certificate or a Blanket Certificate by checking the applicable box.

- In the section where the exemption is certified, include a brief explanation of how the purchased property or service is used for an exempt purpose in accordance with N.J.S.A. 54:32B-8.16.

- Describe the agricultural or horticultural commodities produced at your farming enterprise in the designated text area.

- Detail the tangible personal property or service that you are purchasing, including any specific items or services that are relevant.

- Enter the name of the individual or entity making the purchase in the specified field; this should be the person who is authorized to represent the purchasing entity.

- Fill in the business address of the purchaser in the appropriate section.

- Obtain the necessary signature from the farm owner, partner, officer of the corporation, or another qualified representative in the signature field.

- Review all entries for accuracy, then choose to save changes, download, print, or share the completed form for submission to the seller.

Complete your Nj St7 form online today to ensure you receive the appropriate sales tax exemptions for your farming enterprise.

Related links form

You can obtain a resale certificate in NJ by filling out the appropriate application form from the New Jersey Division of Taxation. Make sure to provide accurate information regarding your business and the materials you plan to resell. Submitting a complete application can reduce processing time. Using USLegalForms, you can easily navigate the requirements for obtaining your resale certificate.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.