Loading

Get Declaration For An E-file Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Declaration For An E-File Return online

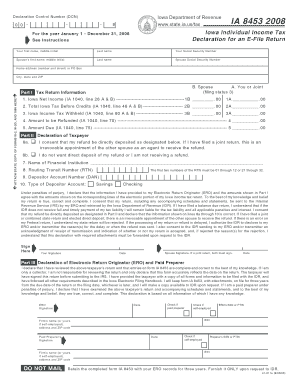

The Declaration For An E-File Return is an essential document for filing your Iowa income tax electronically. This guide provides you with step-by-step instructions to ensure accurate completion of the form, facilitating a smooth filing process.

Follow the steps to fill out the Declaration For An E-File Return online

- Press the ‘Get Form’ button to access the Declaration For An E-File Return and open it in your preferred digital editing tool.

- Complete the taxpayer information section with your first name, middle initial, last name, and your Social Security Number. If filing jointly, include your spouse's details as well.

- Enter your home address accurately, ensuring it matches the information on your electronically filed IA 1040.

- In Part I, report your Iowa Net Income in the fields designated 1A and 1B, using only whole dollars.

- Fill in the Total Iowa Tax Before Credits in fields 2A and 2B, ensuring amounts are correct and correspond to your IA 1040.

- Provide the Iowa Income Tax Withheld amounts in sections 3A and 3B.

- Indicate your expected refund or amount due in lines 4 and 5, reflecting corresponding information from your Iowa tax return.

- In Part II, consent to direct deposit of your refund by filling out lines 6a or 6b based on your preference.

- Fill in the name of your financial institution, the Routing Transit Number (RTN), and Depositor Account Number (DAN) as required.

- Sign and date the form in the designated areas. If filing jointly, both you and your spouse must sign.

- If applicable, ensure the electronic return originator (ERO) completes Part III, signing on your behalf and providing their firm information.

- Review the form for accuracy, save your changes, and ensure all attachments are included when required.

Begin your online filing journey today and complete your Declaration For An E-File Return effortlessly!

If the taxpayer is signing the electronically filed return by using a PIN, use Form 8879, California e-file Signature Authorization for Individuals. If the taxpayer is signing the return via handwritten signature, use Form 8453, California e-file Return Authorization for Individuals.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.