Loading

Get Form 9000

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 9000 online

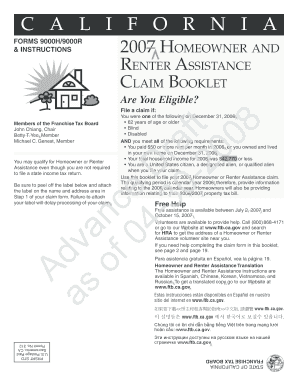

Filling out the Form 9000 online can streamline the process of applying for homeowner and renter assistance. This guide provides detailed, step-by-step instructions to help users navigate each section of the form effectively.

Follow the steps to successfully complete your online Form 9000

- Press the ‘Get Form’ button to acquire the form and access it in the available editor.

- In Step 1, enter your name and address. If the booklet provides a label, attach it here. If not, type your full name and mailing address in the designated fields.

- In Step 2, provide your Social Security Number (SSN). If you are married, include your spouse’s SSN as required.

- Proceed to Step 3 to confirm your filing status by answering whether you are a United States citizen. Provide additional information if applicable.

- In Step 4, renters should complete the rental information section, while homeowners will move to the property information section. Provide dates, landlord details, and other required information.

- Follow to Step 5 to report the yearly income of your household members. Ensure to include all relevant income sources while excluding ineligible types.

- For homeowners, in Step 6 calculate and input the homeowner assistance claimed based on your property tax bill details in the following sections if applicable.

- In Step 7, sign and date your claim form. It's crucial to ensure all sections are completed accurately before submission.

- Finally, review your claim form to ensure that all required documents are attached before mailing it to the Franchise Tax Board at the provided address.

Submit your Form 9000 online today to secure your homeowner or renter assistance.

A W-9 form is an IRS tax form that a freelancer or contractor fills out. W-9 forms are required for all self-employed workers, like independent contractors, vendors, freelancers, and consultants. W-9 forms show that the taxpayer is not subject to backup withholding and is responsible for paying their own taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.