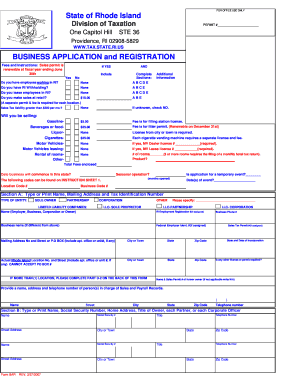

Get State Of Rhode Island Division Of Taxation Business Application And Registration Fillable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the State Of Rhode Island Division Of Taxation Business Application And Registration Fillable Form online

Filling out the business application and registration form with the State of Rhode Island Division of Taxation can be straightforward with the right guidance. This step-by-step guide will help you navigate through each section of the form to ensure accurate and complete submission.

Follow the steps to successfully complete your business application.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Begin with Section A, where you need to type or print your name, mailing address, and tax identification number. Select the type of entity that represents your business, such as 'sole owner,' 'partnership,' or 'corporation.' Be sure to provide the required details accurately.

- In Section B, provide each owner, partner, or corporate officer's name, social security number, and home address. Ensure that titles are clearly indicated.

- For Section C, fill in the payroll information, including the expected amount of Rhode Island withholding taxes you will withhold from employees each month. Provide your filing status and the number of employees.

- In Section D, describe your business activities, products, or services. Clearly outline your principal business activities and the percentage of sales or revenues for each, ensuring the total adds up to 100%. If applicable, complete Part D-2 to indicate multiple business locations.

- In Section E, certify that the information you've provided is accurate by signing and dating the application. This section must be completed by you or an authorized representative.

- After completing all sections, you can review your application for accuracy. You may then save changes, download the completed form, print it out, or share it as required.

Start filling out your business application online today for a smoother registration process.

Rhode Island does provide an e-file authorization form for taxpayers who want to file their taxes electronically. This form allows you to grant permission for tax professionals to file your returns on your behalf. Utilizing the e-file authorization can streamline your filing process with the State Of Rhode Island Division Of Taxation. To ensure compliance, consider using the Business Application And Registration Fillable Form available through USLegalForms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.