Loading

Get Formulario 575

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Formulario 575 online

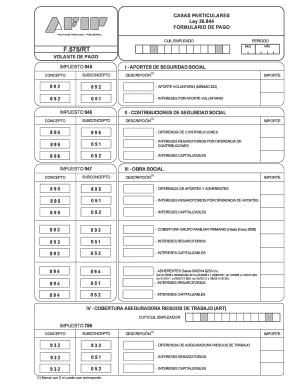

The Formulario 575 is an essential document for reporting various contributions and payments relating to social security and insurance. This guide provides step-by-step instructions to assist users in completing the form accurately and efficiently online.

Follow the steps to complete the Formulario 575

- Click ‘Get Form’ button to obtain the form and open it in your editing platform.

- Begin by entering the 'Periodo' section, indicating the month and year that correspond to the payments being reported.

- In the 'Aportes de Seguridad Social' section, you will see multiple concepts. For each contribution, select the appropriate option and enter the corresponding amounts in the 'Importe' section.

- Continue to the 'Contribuciones de Seguridad Social' section. Similarly, select the concepts that apply to your case and fill in the amounts required.

- Next, move to the 'Obra Social' section. Here, outline any differences in contributions and include the amounts for each related 'subconcepto'.

- Proceed to the 'Cobertura Aseguradora Riesgos de Trabajo' section. Fill this section out by marking the relevant options and entering amounts as required.

- After entering all the necessary information, review the entire form for accuracy. Ensure all fields are completed and that amounts are correct.

- Once you have verified that all information is complete, you can save your changes, download the form, print it, or share it as needed.

Start completing your Formulario 575 online today!

A CP 575 or 147C letter is a communication from the IRS that confirms your Employer Identification Number (EIN). The Formulario 575 serves as proof of your business’s identity and tax status. Understanding this document is crucial for ensuring compliance, and US Legal Forms provides resources to help you manage these letters effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.