Get Illinois W 4

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Illinois W 4 online

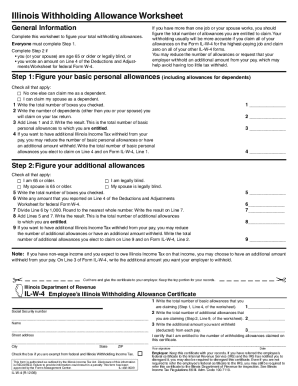

Completing the Illinois W 4 form accurately is vital for ensuring the correct amount of Illinois income tax is withheld from your pay. This guide provides step-by-step instructions to help you fill out the form online with ease.

Follow the steps to accurately complete your Illinois W 4 online.

- Press 'Get Form' button to obtain the form and open it in the editor.

- Fill in your personal information such as your name, address, and Social Security number at the top of the form.

- In the 'allowances' section, check the boxes that apply to you to determine the number of basic personal allowances you are entitled to claim, based on the worksheet instructions.

- Complete the additional allowances section if applicable, marking any relevant boxes regarding age or disability.

- Write the total number of basic allowances and any additional allowances you are claiming in the designated spaces.

- Specify any additional amount you want withheld from each paycheck, particularly if you have non-wage income and expect to owe Illinois income tax.

- Sign and date the form to certify that you are entitled to the stated credits before submitting it to your employer.

- Once completed, save your changes, and share or print the form as needed for your records.

Complete your Illinois W 4 and ensure proper tax withholding by filling out the form online today.

To file an Illinois tax return, you will need to complete the appropriate forms, such as the IL-1040, detailing your income and deductions. You can file your tax return online through the Illinois Department of Revenue's website, or you can mail a paper return. Additionally, keeping your Illinois W 4 information handy will help you ensure that your withholding aligns with your tax obligations. For further assistance, platforms like USLegalForms can offer step-by-step guidance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.