Loading

Get Ccc 941 Form 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ccc 941 Form online

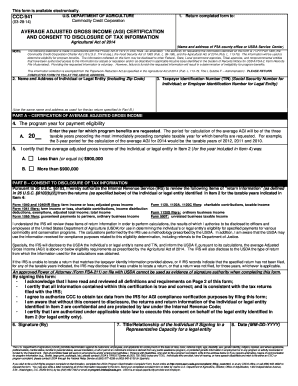

The Ccc 941 Form is a crucial document for individuals and legal entities seeking program benefits from the Commodity Credit Corporation. This guide will help you understand how to fill out this form online, ensuring that you provide all necessary information accurately and efficiently.

Follow the steps to complete the Ccc 941 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name and address of the FSA county office or USDA Service Center where the completed form will be submitted.

- In the designated field, input the name and address of the individual or legal entity, ensuring it matches the details used in the IRS tax returns.

- Provide the Taxpayer Identification Number (TIN) in the specified format. For individuals, this is your Social Security Number; for entities, your Employer Identification Number.

- Indicate the program year for which you are requesting benefits. This will determine the relevant three-year period for average adjusted gross income calculation.

- Select the box that reflects whether the average adjusted gross income for the relevant three-year period is less than or equal to $900,000, or more than $900,000.

- Carefully read the acknowledgments and responsibilities. Then proceed to affix your signature, certifying that all information is accurate.

- Fill in your title or relationship to the legal entity if signing on behalf of an organization.

- Enter the date of your signature in the format MM-DD-YYYY.

- Finally, ensure to return the completed form to FSA within 90 days of the signature date to maintain the validity of the consent.

Complete your Ccc 941 Form online today to ensure eligibility for your program benefits.

Reconciling your 941 involves checking that the figures on your Form 941 match your payroll reports. You should review totals for taxable wages, taxes withheld, and any credits you are claiming. If discrepancies arise, consider consulting resources like US Legal Forms for guidance, ensuring your Ccc 941 Form is accurate and compliant with IRS requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.