Get W 4v

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W-4V online

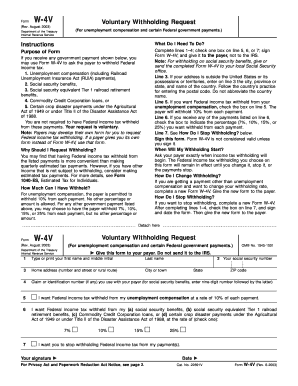

This guide provides clear and concise instructions on how to complete the W-4V form, which is used to request voluntary federal income tax withholding from unemployment benefits and certain federal payments. By following these steps, users can confidently submit their request online while ensuring compliance with the necessary regulations.

Follow the steps to complete the W-4V form effectively.

- Press the ‘Get Form’ button to access the W-4V form. This will allow you to open the form in your online editor for filling out.

- Fill in your first name and middle initial in the first field, followed by your last name in the next field.

- Enter your social security number in the designated field. This is essential for accurately processing your request.

- Provide your home address by filling in the number and street or rural route, as well as your city or town. Complete the state and ZIP code sections.

- On line 5, check the box if you want federal income tax withheld from your unemployment compensation at a rate of 10% from each payment.

- On line 6, if you want tax withheld from any of the payments listed (such as social security benefits), check the box indicating the percentage you would like withheld: 7%, 10%, 15%, or 25%.

- On line 7, check the box if you wish to stop withholding federal income tax from your payments.

- Sign and date the form at the bottom to validate your request.

- Once you have completed all the required fields, save your changes, download, print, or share the completed form as necessary.

Start completing your W-4V form online now to ensure timely processing.

Most deductions from your paycheck include federal income tax, Social Security tax, and Medicare tax, which are essential components of your financial contributions to the government. Other possible deductions could be for state taxes, health insurance, and retirement contributions. Understanding these deductions is crucial for managing your finances effectively, and resources like uslegalforms can provide insights and tools to help you track these expenses.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.