Loading

Get 41500 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 41500 online

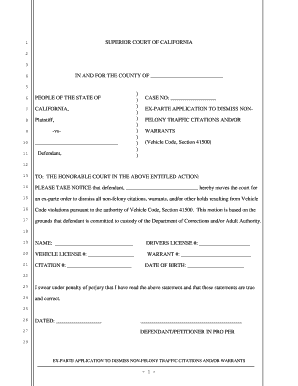

The 41500 form is a legal document used in California for requesting the dismissal of non-felony traffic citations and warrants. This guide provides clear, step-by-step instructions to help you successfully complete and submit the form online.

Follow the steps to complete the 41500 form with ease.

- Click ‘Get Form’ button to obtain the form and access it in the designated online platform.

- In the first section of the form, enter your case number as it appears on any previous court documents related to your case.

- Next, provide the defendant's name in the designated field. Ensure that the name matches the legal name of the person applying for dismissal.

- Fill in the driver's license number accurately in the corresponding field. If the defendant does not possess a driver's license, write 'N/A'.

- Enter the vehicle license number if applicable. If there is no vehicle, indicate 'N/A'.

- Complete the fields for warrant and citation numbers, filling them in as identified on any notification documents. Use 'N/A' if not applicable.

- Input the date of birth for the defendant in the specified format to ensure it is correctly recorded.

- Review the statement confirming your understanding and accuracy of the information provided. It's essential to be honest, as false statements can have legal consequences.

- Finalize the form by signing in the designated area. If you are submitting the form on behalf of another person, ensure authorization is documented.

- After completing the form, save any changes made. You can then download, print, or share the completed form as necessary.

Complete your 41500 form online today to ensure your request is processed promptly.

Filing net trade income requires a clear summary of all income and expenses related to your trade activities. Use financial statements and records to calculate your net income accurately. This can be done using the appropriate forms, including your income tax returns. Platforms like uslegalforms streamline this process, ensuring you remain compliant and organized.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.