Loading

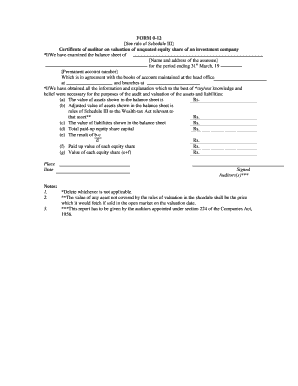

Get Form 0-12 Certificate Of Auditor On Valuation Of Unquoted

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FORM 0-12 Certificate Of Auditor On Valuation Of Unquoted online

Filling out the FORM 0-12 Certificate Of Auditor On Valuation Of Unquoted is an essential task for auditors assessing unquoted equity shares of investment companies. This guide will walk you through the process of completing the form online with clarity and precision.

Follow the steps to effectively complete the form.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by entering the name and address of the assessee in the designated fields to identify the investment company you are auditing.

- In the section for the period ending, input the date of 31st March of the relevant financial year.

- Enter the permanent account number (PAN) of the assessee; this is necessary for identification and tracking purposes.

- Provide details of the head office's location and any branch locations if applicable, ensuring that you accurately represent where the records are maintained.

- In the section regarding the value of assets, accurately report the value of assets shown in the balance sheet.

- For adjusted values, calculate and input the amount that adheres to the rules of Schedule III to the Wealth-Tax Act relevant to that asset.

- Enter the total value of liabilities as shown in the balance sheet to complete the financial overview.

- State the total paid-up equity share capital in the corresponding field, as this is critical for valuation.

- Compute the result of the adjusted value of assets minus liabilities and input this value.

- Determine the paid-up value for each equity share and record this amount in the specified field.

- Finally, calculate the value of each equity share by adding the results from step ten and step eleven, then fill in the resulting amount.

- Review all entered information carefully. Once everything is confirmed, you can save changes, download a copy, and print the form for your records.

Complete your forms efficiently online to ensure timely and accurate submissions.

Warranty claims and associated service costs typically range between 2% and 15% of net sales (Murthy, 2006). Warranty accruals are monies set aside when goods are first sold for fulfilling future claims, based on the firm's projection of future warranty claim costs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.