Loading

Get Bajaj Finance Loan Application Form Pdf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bajaj Finance Loan Application Form Pdf online

Filling out the Bajaj Finance Loan Application Form online can be a streamlined process with the right guidance. This guide will provide clear instructions on completing each section of the form accurately to enhance your loan application experience.

Follow the steps to successfully complete your loan application.

- Click 'Get Form' button to obtain the form and open it in your preferred document editing tool.

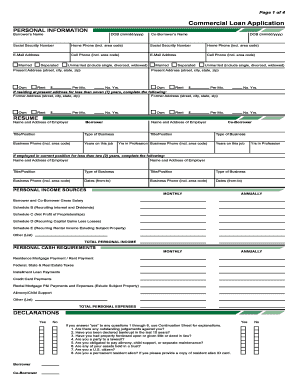

- Begin by entering the personal information of the borrower in the designated fields. Include the borrower's name, date of birth, social security number, and contact details such as home and cell phone numbers, ensuring all details are current and accurate.

- For the co-borrower, repeat the process by entering their name, date of birth, social security number, and contact details in the corresponding fields.

- Provide your marital status by selecting the appropriate option among married, separated, or unmarried. Fill in both the present address and any previous addresses if applicable, particularly if you have lived in your current residence for less than seven years.

- Enter employment details for both the borrower and co-borrower. This includes the name and address of the employer, job title, and business contact information. If employed less than two years in the current position, include information about previous employers.

- List all personal income sources. Fill in the monthly and annual gross salary along with any additional income sources such as interested dividends or rental income.

- Followed by entering personal expenses. Document all monthly expenses including mortgage payments, taxes, loan payments, and other financial obligations.

- Proceed to the declarations section and answer the questions truthfully regarding judgments, bankruptcies, and lawsuits. If any apply, be prepared to provide additional details on a separate sheet.

- Complete the assets and liabilities section by accurately listing all assets, including cash, real estate, and vehicles. Each should reflect the current market value along with all outstanding debts.

- Provide information about the property to be financed, including loan amount requested, purpose, and property address along with other relevant details like the year built and type of property.

- Fill out the business information and ownership sections if applying as a business applicant, detailing the type of business and ownership structure.

- Finish by reviewing the acknowledgment and agreement section. Ensure you understand the implications of your statements and sign the form as required.

- Once all sections are filled, save your changes, and consider downloading or printing the form for your records or submission.

Begin filling out your Bajaj Finance Loan Application Form online to streamline the process and secure your loan.

Typically, a Bajaj Finserv EMI Network Card grants you access to a pre-approved limit of ₹2 Lakhs. This amount is based on several factors, including your finances and your credit profile.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.