Loading

Get Form 8936 Identifying Number

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8936 Identifying Number online

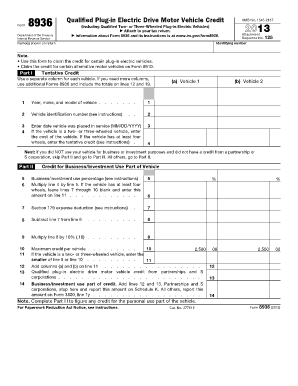

Filling out Form 8936 is essential for claiming the tax credit for qualified plug-in electric drive motor vehicles. This guide provides straightforward instructions to assist users in accurately completing the form online.

Follow the steps to fill out Form 8936 online.

- Press the ‘Get Form’ button to acquire the form and open it in your browser.

- In the Identifying Number section, enter your unique identification number as required.

- Proceed to enter the names shown on your tax return in the designated field.

- Complete Part I by inputting the year, make, and model of the vehicle in the designated row.

- Enter the vehicle identification number (VIN) in line 2. You can find this on your vehicle registration document or title.

- Input the date the vehicle was placed in service using the MM/DD/YYYY format.

- For two- or three-wheeled vehicles, enter the cost of the vehicle, otherwise enter the allowable tentative credit for vehicles with four or more wheels.

- If your vehicle was not used for business or investment purposes, skip Part II and move to Part III.

- For vehicles with a business or investment use, complete the relevant fields in Part II, including the percentage of business use on line 5.

- Finalize Part III if applicable, entering any personal use credits on the appropriate lines.

- Review the entire form for accuracy and completeness, then proceed to save your changes.

- You can now download, print, or share the completed form as necessary.

Complete your Form 8936 online today to claim your eligible credit.

To claim your federal EV tax credit, you must fill out Form 8936 along with Form 1040. If you purchased your EV more than 3 years ago and the vehicle is still eligible for the tax credit, you can file an amended return to claim your credit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.