Loading

Get Ct Nrp 1 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct Nrp 1 online

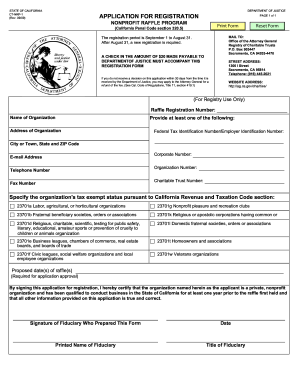

The Ct Nrp 1 form is essential for registering a nonprofit raffle program in California. This guide offers clear, step-by-step instructions on how to complete the form online, ensuring that all necessary information is accurately provided.

Follow the steps to successfully complete the Ct Nrp 1 form online.

- Press the ‘Get Form’ button to access the Ct Nrp 1 form and open it in your preferred online format.

- Begin by entering the name of your organization in the designated field at the top of the form.

- Next, provide the address of your organization, including street address, city or town, state, and ZIP code.

- If applicable, include your organization’s Federal Tax Identification Number or Employer Identification Number in the respective field.

- Fill in the corporate number and any other organization identification numbers as required.

- Indicate your organization's tax exempt status by selecting one of the options listed, based on the California Revenue and Taxation Code.

- Provide the proposed date(s) of your raffle, which is necessary for the application approval.

- In the certification section, review the statement and prepare to sign, confirming that your organization meets the necessary criteria.

- Sign the form in the designated area, including the printed name and title of the fiduciary who prepared the form.

- Finally, save your changes, and you can choose to download, print, or share your completed form as needed.

Complete your Ct Nrp 1 form online today to ensure your nonprofit raffle registration is processed efficiently.

To set up a raffle, start by determining the purpose and choosing a prize that will attract participants. Next, register your organization with the California Department of Justice, as required by the Ct Nrp 1 regulations. Finally, create a ticket sales strategy and promote your raffle to maximize participation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.