Get Ak Dor 544 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AK DoR 544 online

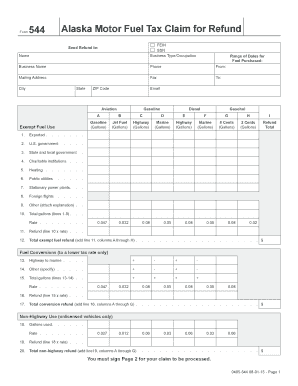

The AK DoR 544 form, known as the Alaska Motor Fuel Tax Claim for Refund, allows individuals and businesses to claim refunds on fuel taxes. This guide will provide you with a clear, step-by-step approach to filling out the form online, ensuring that all necessary information is accurately submitted.

Follow the steps to complete the AK DoR 544 form successfully.

- Click the ‘Get Form’ button to access the AK DoR 544 document and open it in your preferred editor.

- Begin filling in your personal details, including your name, FEIN or SSN, business type or occupation, business name, phone number, mailing address, city, state, ZIP code, and email address. Ensure accuracy in all entries.

- Indicate the type of fuel for which you are claiming a refund (e.g., aviation, exempt fuel use, gasoline, diesel) and enter the corresponding gallon amounts for each category.

- Complete the sections for fuel conversions, listing any conversions from highway to marine or other specified uses, along with the respective amounts and rates.

- Fill out the non-highway use section, providing details on gallons used and the applicable rate for unlicensed vehicles.

- Proceed to the refined fuel surcharge exempt use section, detailing gallons used and calculating the refund amounts for each fuel type.

- Ensure you complete the total claim for refund section accurately by adding up all relevant lines from previous sections.

- Sign and date the form on Page 2 to validate your claim. Ensure all required attachments, such as original invoices, are included.

- Once all fields are filled, save your changes, then download, print, or share the completed form as necessary.

Start filling out your AK DoR 544 form online today to ensure you secure your fuel tax refund.

Alaska does not impose a state-level sales tax; however, certain business taxes apply, depending on your industry and revenue. It's important to understand the various tax reporting requirements as outlined in AK DoR 544 to avoid penalties. The Department of Revenue provides resources for businesses to navigate these tax obligations effectively. By staying informed, you can optimize your tax strategy and ensure compliance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.