Loading

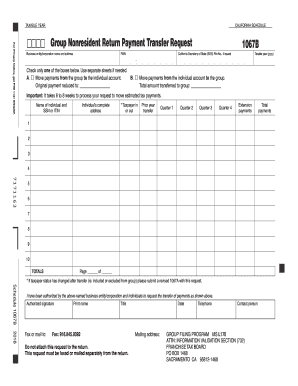

Get Ca Ftb Schedule 1067b 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB Schedule 1067B online

Filling out the CA FTB Schedule 1067B is an important task for individuals and businesses involved in group nonresident returns in California. This guide will provide a clear, step-by-step approach to help you efficiently complete the form online.

Follow the steps to complete the CA FTB Schedule 1067B online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the business entity or corporation name and address in the designated fields. Ensure this information matches the records maintained by the California Secretary of State.

- Provide the Federal Employer Identification Number (FEIN) in the appropriate field to identify your business entity.

- If applicable, enter the California Secretary of State File Number, if issued, to further identify your business entity.

- Fill in the taxable year using the format (yyyy). This will indicate the corresponding tax period for which you are making the transfer.

- Check one of the boxes to indicate whether you want to move payments from the group to the individual account or vice-versa. Use separate sheets if necessary for additional requests.

- If transferring payments, enter the original payment reduced amount and the total amount being transferred to the group.

- Provide the name of the individual and their Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) in the required fields.

- Complete the individual’s full address, ensuring accuracy to avoid any processing delays.

- Indicate the taxpayer’s status (in or out of the group) and account for any prior year transfers.

- Fill out the total payments for each quarter (1 through 4) and include any extension payments as applicable.

- After completing the required fields, provide an authorized signature, print their name, and include the title of the signatory.

- Include the date, telephone number, and contact person's details in the fields provided.

- Finally, save your changes, download the completed form, or print it as needed. Remember to fax or mail the form separately, as it should not be attached to the return.

Start completing your CA FTB Schedule 1067B online today to ensure accurate and timely processing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

For your California tax return, always opt for paperclipping instead of stapling. This approach not only protects your documents but also eases the processing for the Franchise Tax Board. Remember, if you are submitting the CA FTB Schedule 1067B or other schedules, maintaining clarity and organization can be beneficial.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.