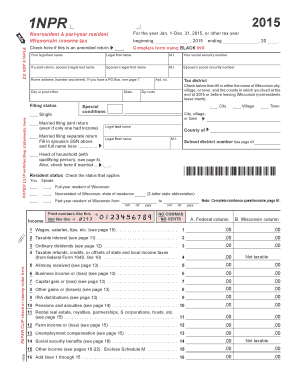

Get Wi Dor 1npr 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign WI DoR 1NPR online

How to fill out and sign WI DoR 1NPR online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Filling out tax documents can become a significant barrier and immense frustration if the right support is not available. US Legal Forms was created as an online resource for WI DoR 1NPR e-filing and offers multiple advantages for taxpayers.

Utilize the guidelines on how to fill out the WI DoR 1NPR:

Utilize US Legal Forms to ensure safe and straightforward completion of the WI DoR 1NPR.

- Access the form online in the designated section or through the search engine.

- Click the orange button to open it and wait for it to finish loading.

- Review the blank and pay close attention to the instructions. If you have never filled out the template before, follow the step-by-step guidance.

- Pay special attention to the yellow fields. They are editable and require specific information to be entered. If you are unsure about what to include, refer to the instructions.

- Always sign the WI DoR 1NPR. Use the integrated tool to create your electronic signature.

- Click on the date field to automatically fill in the correct date.

- Review the document to verify and amend it before e-filing.

- Click the Done button in the top menu once you have completed it.

- Save, download, or export the finished document.

How to Modify Get WI DoR 1NPR 2015: Personalize Forms Online

Utilize our all-inclusive editor to convert a basic online template into a finished document. Continue reading to discover how to modify Get WI DoR 1NPR 2015 online effortlessly.

Once you locate a suitable Get WI DoR 1NPR 2015, all you need to do is adapt the template to your preferences or legal stipulations. Besides completing the fillable form with precise details, you may need to eliminate some clauses in the document that are not pertinent to your situation. Alternatively, you might wish to incorporate some absent stipulations in the original form. Our sophisticated document editing tools are the most straightforward method to amend and modify the document.

The editor enables you to adjust the content of any form, even if the document is in PDF format. It is feasible to add and delete text, insert fillable fields, and implement additional modifications while maintaining the original formatting of the document. You can also reorganize the layout of the document by altering the page sequence.

You do not need to print the Get WI DoR 1NPR 2015 to endorse it. The editor includes electronic signature capabilities. Most of the forms already possess signature fields. Thus, you only need to affix your signature and request one from the other signing party with a few clicks.

Follow this step-by-step guide to create your Get WI DoR 1NPR 2015:

After all parties endorse the document, you will receive a signed copy which you can download, print, and distribute to others.

Our solutions enable you to save significant time and minimize the likelihood of errors in your documents. Improve your document workflows with effective editing tools and a robust eSignature solution.

- Open the desired form.

- Utilize the toolbar to tailor the template to your preferences.

- Complete the form supplying accurate information.

- Click on the signature field and insert your electronic signature.

- Send the document for signature to other signers if needed.

Get form

To register for Wisconsin withholding, you need to fill out the necessary forms through the Wisconsin Department of Revenue. This process can be completed online or via paper forms, depending on your preference. Ensure you have your business details handy to streamline registration. Uslegalforms can assist you in finding the right forms and understanding the registration steps.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.