Loading

Get Ca Ftb 8879 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 8879 online

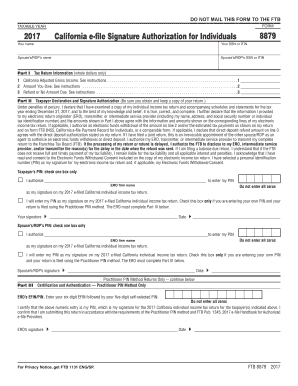

The CA FTB 8879 is the California e-file signature authorization form for individuals. This guide will provide you with clear, step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to fill out the CA FTB 8879 online.

- Click the ‘Get Form’ button to obtain the form and open it in an online editor.

- Enter your name and your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) in the respective fields.

- If applicable, provide your spouse's or registered domestic partner's name and their SSN or ITIN.

- In Part I, complete the Tax Return Information by providing whole dollar amounts for California Adjusted Gross Income on line 1, any amount you owe on line 2, and any refund or amount due on line 3, as applicable.

- In Part II, read and understand the Taxpayer Declaration and Signature Authorization section, ensuring that all information is accurate.

- Select and mark the appropriate box to authorize either your Electronic Return Originator (ERO) to enter your Personal Identification Number (PIN) or indicate that you will enter your own PIN.

- Sign and date the form in the provided fields to validate your declaration. Ensure that both you and your spouse or registered domestic partner complete this step if filing jointly.

- If using the Practitioner PIN method, complete Part III by entering the ERO's six-digit EFIN followed by the five-digit self-selected PIN. The ERO must sign and date this section.

- After completing all sections, review the information entered for accuracy. Save your changes, and download or print the form as needed.

Complete your forms online for a streamlined filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Whether you need to file a California state tax return depends on various criteria, such as your income and residency status. If your earnings exceed California's established minimum filing threshold, you are required to file. By understanding these requirements, and utilizing resources like the CA FTB 8879 form, you can ensure compliance. It’s essential to review your financial situation or consult a tax professional for clarity.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.