Get Mo Mo-ptc 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO MO-PTC online

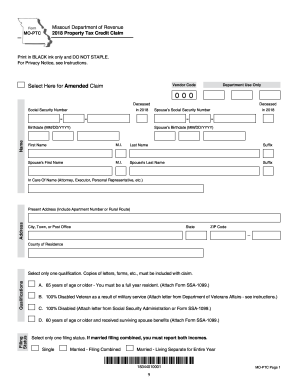

The MO MO-PTC form, or Property Tax Credit Claim, is essential for eligible individuals seeking to claim a property tax credit in Missouri. This guide provides step-by-step assistance to ensure the form is completed accurately and submitted online with ease.

Follow the steps to complete your MO MO-PTC form effectively.

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal information. Input your name(s), address, social security number(s), birthdate(s), and contact telephone number in the appropriate spaces.

- Select the applicable qualification box that applies to your eligibility. Ensure that you attach documentation to support your selection as specified.

- Indicate your filing status by selecting the correct option. If you are married and filing combined, report both incomes as required.

- Complete the household income section by entering amounts for social security benefits, wages, pensions, and any other income. Attach necessary forms such as W-2 or 1099.

- If applicable, enter the amount of property tax paid for your home or the rent you paid. Remember to include the proper supporting documentation.

- Determine and fill in your filing deductions based on your filing status. Use the specific amounts for your situation as directed in the form.

- Calculate your total real estate tax or rent paid and ensure it does not exceed the maximum allowable limits.

- Review your entries to ensure accuracy, especially checking the necessary attached documentation. Failure to provide this may delay your refund.

- Once all information is verified, authorize your claim by signing the form. Both spouses must sign for combined filings.

- Finalize your submission by saving your changes, downloading a copy, and printing the form to mail it or sharing if necessary.

Complete your MO MO-PTC form online today to ensure efficiency in your property tax credit claim.

Get form

Related links form

To apply for tax-exempt status in Missouri, you must fill out the appropriate forms and provide necessary documentation about your organization. This typically includes details about your nonprofit activities and finances. Having all documentation in order can streamline the application process. For additional support, visit the US Legal Forms platform, which offers guidance through each step of applying for tax-exempt status.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.