Loading

Get Nc B-c-715 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC B-C-715 online

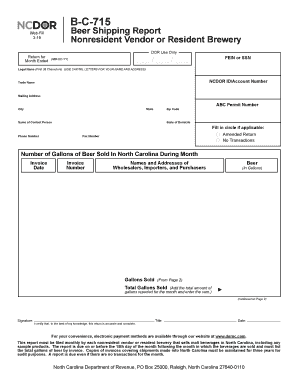

The NC B-C-715 is a necessary form for nonresident vendors and resident breweries to report beer sales in North Carolina. This guide provides clear, step-by-step instructions on how to complete the form online, ensuring a smooth and efficient filing process.

Follow the steps to fill out the NC B-C-715 accurately.

- Press the ‘Get Form’ button to access the NC B-C-715 and open it in your online editor.

- Fill in the FEIN or SSN as applicable. Ensure that all numbers are accurate to avoid issues with your submission.

- Enter your legal name in the first 35 characters, using capital letters. This is important for identification purposes.

- Provide your NCDOR ID or account number. This helps in tracking your submissions within the department.

- Type in your trade name, if applicable, followed by the mailing address, city, state, and zip code.

- Include your ABC permit number and state of domicile to ensure compliance with state regulations.

- Add the name of the contact person and their phone number, along with a fax number if necessary. This facilitates communication if needed.

- Indicate if this is an amended return or if there were no transactions during the month by filling in the relevant circle.

- Record the number of gallons of beer sold in North Carolina during the month. Fill this out for each invoice by entering the invoice date, number, and details of wholesalers, importers, and purchasers.

- Calculate the total gallons sold and enter the sum on the designated line. Ensure accuracy to comply with reporting requirements.

- Sign and date the form at the bottom, certifying that the information provided is accurate. Add your title as needed.

- Once all sections are completed, save your changes. You may also download, print, or share the completed form as needed.

Complete the NC B-C-715 form online to ensure your compliance in reporting beer sales.

Some states do not accept federal tax extensions and require their own specific forms and deadlines. North Carolina, for example, has its unique filing processes, including the NC B-C-715. It's crucial to check each state's requirements to ensure compliance and avoid any filing issues. Being aware of state-specific rules can prevent unnecessary complications.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.