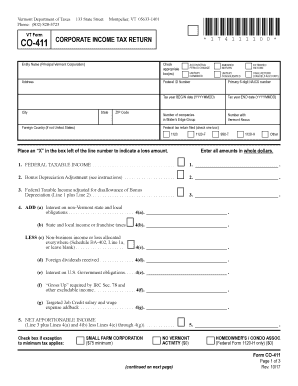

Get Vt Dot Co-411 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign VT DoT CO-411 online

How to fill out and sign VT DoT CO-411 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Tax form filling can turn into a significant barrier and major frustration if no suitable aid is provided. US Legal Forms has been developed as an online solution for VT DoT CO-411 e-filing and presents numerous benefits for the taxpayers.

Follow the instructions on how to complete the VT DoT CO-411:

Use US Legal Forms to ensure straightforward and efficient VT DoT CO-411 completion.

Locate the template on the website in the specific section or through the Search engine.

Click the orange button to access it and wait for it to load.

Review the template and pay close attention to the suggestions. If you have never completed the template before, adhere to the step-by-step guidance.

Focus on the yellow fields. They are editable and require specific information to be entered. If you are unsure what information to provide, consult the instructions.

Always sign the VT DoT CO-411. Utilize the integrated tool to create the electronic signature.

Click the date field to automatically insert the appropriate date.

Review the template to press and modify it before submission.

Hit the Done button on the upper menu once you have finalized it.

Save, download, or export the completed document.

How to Modify Get VT DoT CO-411 2015: Personalize Forms Digitally

Utilize the convenience of the versatile online editor while completing your Get VT DoT CO-411 2015. Take advantage of the variety of tools to swiftly fill in the blanks and provide the required information immediately.

Preparing documents can be time-consuming and expensive unless you have accessible fillable forms to complete electronically. The easiest way to handle the Get VT DoT CO-411 2015 is to use our expert and multifunctional online editing tools. We offer you all the necessary instruments for rapid document completion and enable you to make any modifications to your forms, tailoring them to any requirements. Additionally, you can add comments on the revisions and leave notes for other involved parties.

Here’s what you can accomplish with your Get VT DoT CO-411 2015 in our editor:

Managing the Get VT DoT CO-411 2015 in our robust online editor is the fastest and most efficient way to organize, submit, and disseminate your paperwork as you need it from anywhere. The tool operates from the cloud, allowing you to access it from any location on any internet-enabled device. All forms you create or complete are securely stored in the cloud, ensuring you can always retrieve them when necessary and be assured of not losing them. Stop spending time on manual document completion and eliminate paper; conduct everything online with minimal effort.

- Complete the blank fields using Text, Cross, Check, Initials, Date, and Sign tools.

- Emphasize important details with a preferred color or underline them.

- Obscure sensitive information using the Blackout tool or simply erase them.

- Insert images to illustrate your Get VT DoT CO-411 2015.

- Substitute the original text with one that meets your needs.

- Add comments or sticky notes to notify others about the updates.

- Place additional fillable fields and assign them to designated individuals.

- Secure the template with watermarks, include dates, and bates numbers.

- Share the document in multiple formats and save it on your device or the cloud right after editing.

Get form

Related links form

As mentioned earlier, Vermont does implement a pass-through entity tax. This tax structure supports business owners by avoiding double taxation. The VT DoT CO-411 contains critical information on how this tax is applied in Vermont, helping you comply with state regulations. Utilizing resources like UsLegalForms can assist you in understanding your responsibilities as a business owner.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.