Loading

Get Wa Dor 2434e 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WA DoR 2434e online

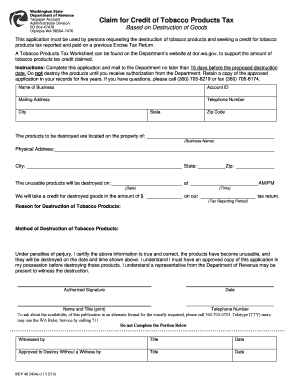

Filling out the WA DoR 2434e form is an essential step for those requesting a credit for tobacco products tax based on the destruction of goods. This guide will provide you with clear, step-by-step instructions to ensure a smooth process.

Follow the steps to successfully complete the form.

- Press the ‘Get Form’ button to access the application and open it for your input.

- Enter the name of your business in the designated field. Ensure that the name is accurate and matches your official business registration.

- Fill in your Account ID, which is necessary for the Department of Revenue to identify your business accurately.

- Provide your mailing address, including street address, city, state, and zip code. This ensures proper communication regarding your application.

- Input your telephone number in the specified field for any follow-up inquiries from the Department of Revenue.

- Specify the location where the products to be destroyed are located by filling in the business name and physical address.

- Indicate the exact date and time when the destruction of the products will occur.

- State the amount of credit you wish to claim for the destroyed goods alongside the corresponding tax reporting period.

- Provide a detailed reason for the destruction of tobacco products, as well as the method you will use for destruction.

- Sign and date the certification section, confirming that all provided information is accurate and that you will retain an approved copy of the application.

- Once completed, save the form, download a copy, and consider printing it for your records.

Complete and submit your WA DoR 2434e form online today to ensure a timely processing of your tobacco tax credit request.

Excise tax includes business and occupation (B&O), retail sales, and public utility taxes. To pay your bill over the phone, call 1-800-2PAY-TAX (1-800-272-9829). Have the following information ready when you call: Jurisdiction code (5600) or Washington State zip code.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.