Loading

Get Vi Bir 722 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VI BIR 722 online

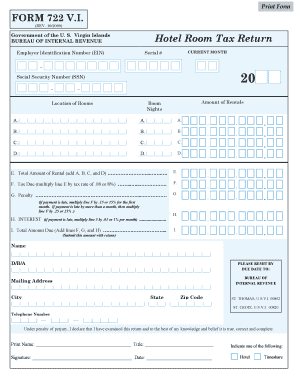

The VI BIR 722 form is used for reporting hotel room tax within the U.S. Virgin Islands. This guide aims to provide a clear, user-friendly approach to completing the form online, ensuring that you understand each component and can submit your tax return accurately.

Follow the steps to complete the VI BIR 722 online effortlessly.

- Click ‘Get Form’ button to access the form and open it in your browser.

- Enter your Employer Identification Number (EIN) in the designated field. This number is essential for identifying your tax account.

- Provide the Serial Number as indicated on the form to ensure proper identification of your submission.

- Fill in the CURRENT MONTH with the applicable month and year for your tax period.

- Input your Social Security Number (SSN) in the required section.

- Indicate the location of your rooms by entering the appropriate address details.

- In the Amount of Rentals section, enter the corresponding Room Nights for each category (A, B, C, and D) that applies to your rental operations.

- Calculate the Total Amount of Rental by adding the amounts from categories A, B, C, and D, and enter it in line E.

- Compute the Tax Due by multiplying the Total Amount of Rental (line E) by the tax rate of 0.08 (or 8%) and enter it on line F.

- Determine any Penalty for late payment based on the guidelines provided, and enter this figure on line G.

- Calculate any Interest due for late payments, entering this total on line H.

- Sum lines F, G, and H to obtain the Total Amount Due, which you must remit with your return, and write this amount on line I.

- Complete the Name and D/B/A fields with the appropriate business information.

- Add your Mailing Address, including City, State, and Zip Code details.

- Fill in your Telephone Number for any necessary correspondence.

- Sign and print your name, providing your title and the date of submission to validate your return.

- Indicate the type of rental operation (Hotel or Timeshare) as required.

- Review all entries to confirm accuracy before submitting. You can then save changes, download, print, or share the completed form.

Start filing your VI BIR 722 online today and ensure compliance with tax regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The hotel tax in the U.S. Islands is applied to stays in all lodging establishments. This tax can vary based on location and type of accommodation. Being aware of this tax under VI BIR 722 can help you budget effectively for your trips to the islands.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.