Loading

Get Vi 720-b 2013-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VI 720-B online

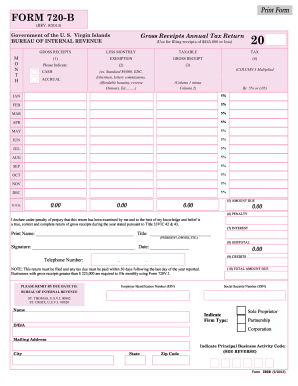

Filling out the VI 720-B, a gross receipts annual tax return for businesses in the U.S. Virgin Islands, is an essential task for individuals and organizations with gross receipts of $225,000 or less. This guide provides clear, step-by-step instructions on how to complete the form online, ensuring accurate reporting and compliance.

Follow the steps to complete the VI 720-B online:

- Click the ‘Get Form’ button to access the document and open it in your preferred digital editor.

- Fill in your firm's name, Employer Identification Number (EIN), or Social Security Number (SSN) as required in the designated fields.

- Indicate the firm type by selecting one option: Sole Proprietor, Partnership, or Corporation.

- Provide your mailing address, including city, state, and zip code, in the corresponding fields.

- Select and enter the Principal Business Activity Code that best describes your business from the provided list.

- Record your gross receipts for the year in the Gross Receipts field and indicate whether you are filing on a cash or accrual basis.

- Calculate the amount of taxable receipts by subtracting any exemptions applied from your gross receipts.

- Compute the tax due by multiplying the taxable receipts by 5%.

- Enter any penalties and interest, if applicable, in the respective fields.

- Review the information for accuracy and sign the form to declare that the return is true, correct, and complete.

- Finally, save the completed form, and if necessary, download, print, or share it as required.

Complete your VI 720-B online to ensure timely and accurate reporting of your gross receipts.

Related links form

You can file your U.S. Islands tax return with the Virgin Islands Bureau of Internal Revenue. It's crucial to submit your return by the designated deadlines to avoid penalties. Using the VI 720-B form simplifies your filing process and provides clear instructions on meeting local tax requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.