Get Va Form Rdc 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA Form RDC online

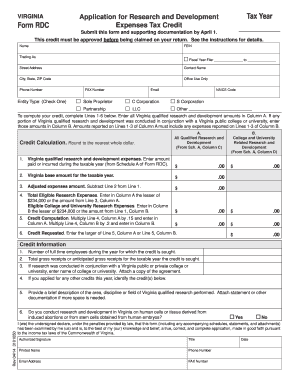

Filling out the VA Form RDC online can be a straightforward process when you follow clear instructions. This guide is designed to help users navigate each section of the form effectively and ensure all necessary information is accurately provided.

Follow the steps to complete the VA Form RDC online

- Press the ‘Get Form’ button to access the form and open it in your preferred online format.

- Begin by entering the tax year you are applying for at the top of the form. This ensures your application is processed for the correct year.

- In the 'Name' field, provide the legal name of your entity. Ensure the name matches official records to avoid processing delays.

- Fill in your FEIN (Federal Employer Identification Number) accurately, as this is essential for tax identification purposes.

- Indicate your ‘Trading As’ name if applicable. Otherwise, leave it blank.

- For fiscal year filers, fill in the dates of your fiscal year period in the provided fields.

- Provide your complete street address, including city, state, and ZIP code, to ensure all correspondence reaches you.

- Enter the name of the primary contact person in the 'Contact Name' field, this person will be the point of communication for this application.

- Fill in the contact information: phone number, fax number, and email address. Double-check to ensure accuracy, particularly the email.

- Input your NAICS code, which is critical for categorizing your business operations.

- Select the type of entity by checking the corresponding box — Sole Proprietor, C Corporation, S Corporation, Partnership, LLC, or Other.

- Proceed to complete lines 1-6 under ‘Credit Calculation’, including all necessary amounts in the appropriate columns, being mindful of the instructions provided.

- For details regarding research conducted with a Virginia college or university, make sure to attach relevant agreements and documents.

- Once all sections are filled correctly, review the form for completeness before submission.

- Finally, save your changes, and choose to download, print, or share the form as needed to keep a record of your application.

Complete the VA Form RDC online today to ensure your tax credit application is submitted correctly.

Get form

The 25% limitation for R&D credit refers to the upper limit on the amount of credit that can be claimed based on a business's total R&D expenses. This means that businesses can only claim a credit equal to 25% of their qualified research expenditures, after accounting for any previous credits claimed. This limitation encourages companies to invest more in R&D activities. To calculate your eligibility efficiently, using the VA Form RDC can provide clarity.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.