Loading

Get Ca Ftb 705 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 705 online

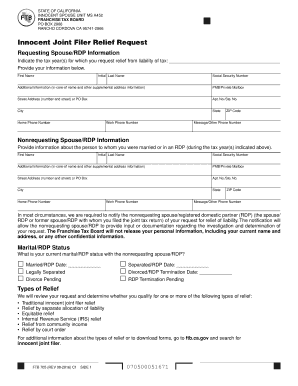

The CA FTB 705 form is a crucial document for individuals seeking innocent joint filer relief from tax liability in California. This guide will provide you with detailed, step-by-step instructions to help you fill out the form online accurately and efficiently.

Follow the steps to complete your CA FTB 705 form online.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Indicate the tax year(s) for which you are requesting relief by filling in the corresponding blank.

- Provide your personal information. Enter your first name, initial, last name, social security number, and any additional address information that may apply.

- Complete your street address, apartment or suite number, city, state, and ZIP code. Don't forget to add your home and work phone numbers, including a message or other phone number if necessary.

- Next, enter the nonrequesting spouse or registered domestic partner's information in the same manner, including their name, social security number, additional address details, and phone numbers.

- Select your current marital or registered domestic partner status by checking the appropriate box and providing relevant dates.

- Choose the type(s) of relief for which you are applying by reviewing the options listed and noting any pertinent details.

- Attach all supporting documents as specified, including statements, tax returns, and any correspondence from the IRS.

- Fax or mail the completed form along with any required documents to the designated address or fax number as noted on the form.

- Finally, sign and date the form, confirming the information is true and correct to the best of your knowledge. You may include your email address, but it is optional.

Complete your CA FTB 705 form online today for timely processing.

Related links form

Claiming exemption from withholding can be beneficial if you expect to owe no taxes for the year due to low income or other deductions. However, it may lead to a larger tax bill when you file if you earn more income than anticipated. To make an informed choice, examine your financial situation in relation to the CA FTB 705 guidelines and consider consulting with USLegalForms for relevant resources.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.