Loading

Get Mo E-234 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO E-234 online

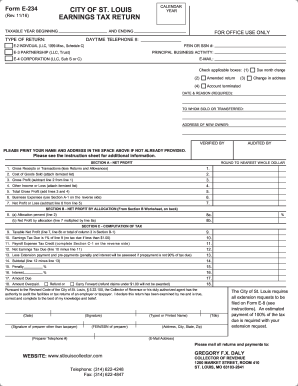

Filling out the MO E-234 form online can be a straightforward process when you understand the components of the form. This guide provides step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the MO E-234 form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Fill in the calendar year and the taxable year beginning and ending dates in the designated fields.

- Select the type of return you are filing by checking the appropriate box: E-2 for individual, E-3 for partnership, and E-4 for corporation.

- Provide your FEIN or SSN number in the appropriate section, along with your daytime telephone number and email address.

- If applicable, check the boxes for any amendments, changes in address, or account termination.

- In Section A, report your net profit by filling in the required fields, including gross receipts, cost of goods sold, and business expenses.

- Calculate the net profit or loss by subtracting your total business expenses from your total gross profit.

- Move to Section B to allocate your net profit as necessary based on the worksheet provided.

- Calculate your taxable net profit in Section C, report the earnings tax due, and apply any payroll tax credits.

- Complete the declaration statement at the end of the form, including your signature and the date.

- Once all sections are complete, save your changes, and choose to download, print, or share the completed form as required.

Start filing your MO E-234 form online today to ensure a smooth and timely submission.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To become exempt from Missouri withholding, you need to meet specific criteria set by the state. Generally, this involves submitting a Form MO W-4 with the appropriate designation for exemption. It's crucial to ensure that your financial situation aligns with the requirements before filing any forms. Consulting the U.S. Legal Forms platform can guide you through the necessary steps and paperwork efficiently.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.