Loading

Get Va Dot St-10 2017-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA DoT ST-10 online

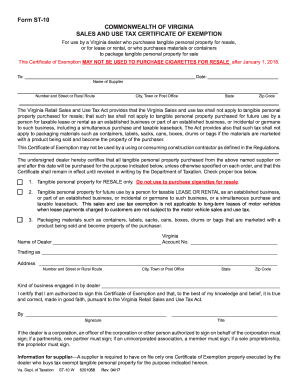

The VA DoT ST-10 is a Sales and Use Tax Certificate of Exemption designed for Virginia dealers purchasing tangible personal property for resale or lease. This guide provides clear, step-by-step instructions on filling out the form easily and effectively, helping users navigate the online process with confidence.

Follow the steps to complete the VA DoT ST-10 form online.

- Press the ‘Get Form’ button to access the VA DoT ST-10 form, which you will be able to open in an online editor.

- Fill in the 'Name of Supplier' section with the complete legal name of the supplier. Next, enter the address details, including the number and street or rural route, city, town or post office, state, and zip code.

- Check the appropriate box indicating the purpose of the exemption. You may select one of the following: 1) Tangible personal property for resale, 2) Tangible personal property for future lease or rental, or 3) Packaging materials that will become the property of the purchaser.

- Enter the 'Name of Dealer' and 'Account Number' in the designated fields. Also, complete the 'Trading as' field with the business name, and the address section with the appropriate details.

- In the 'Kind of business engaged in by dealer' field, provide a brief description of the dealer's business activities.

- The authorized signer should complete the 'Signature' and 'Title' sections. This is essential for validation of the certificate. Ensure that the person signing is authorized to do so based on your business structure.

- After reviewing all entries for accuracy, save the changes made to the form. You can now download, print, or share the completed VA DoT ST-10 Certificate of Exemption for your records or submission.

Complete your documents online today to simplify your filing process.

Related links form

To achieve farm tax-exempt status in Virginia, you must complete the VA DoT ST-10 form. This form verifies that your farming operations meet certain criteria established by the state. Additionally, you may need to provide proof of your agricultural activities to support your application for exemption.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.