Loading

Get Va Dot 763 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA DoT 763 online

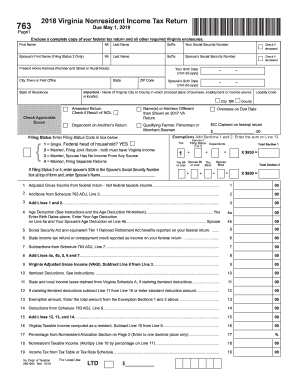

The VA DoT 763 is the Virginia Nonresident Income Tax Return form, designed for individuals who earn income in Virginia while being residents of another state. This guide provides step-by-step instructions on how to accurately complete this form online, ensuring you meet all requirements efficiently.

Follow the steps to complete the VA DoT 763 form online.

- Use the ‘Get Form’ button to access the VA DoT 763 and load it in the online editor.

- Begin by entering your first name, middle initial, and last name in the respective fields. Ensure that the names match those on your federal tax return.

- Input your Social Security Number in the designated box. If applicable, check the box indicating if you are deceased.

- For individuals filing jointly, enter your spouse's first name and last name, along with their Social Security Number, and indicate if they are deceased.

- Provide your present home address, including number, street, city or town, state, and ZIP code.

- Note the state of residence. Include your and your spouse’s birth dates in the format mm-dd-yyyy.

- Complete the filing status section by selecting the appropriate code that corresponds to your situation.

- Fill out the exemptions section by adding the sections regarding dependents and any other applicable exemptions.

- Detail your adjusted gross income as shown on your federal return, then include any additions and subtractions that apply to your income.

- Calculate your Virginia taxable income by using the subtraction and addition lines to finalize your tax computation.

- Complete any remaining sections, including credits, payments, and whether you are owed a refund or required to make a payment.

- Finally, review all entries for accuracy, then save changes, download, print, or share the completed form as necessary.

Complete your VA DoT 763 form online today for a hassle-free tax filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

In Virginia, individuals or entities acting as fiduciaries, managing estates or trusts with income, must file a fiduciary tax return. The requirement applies if the estate or trust has income exceeding the exemption limit set by the state. It is crucial to consult the specific guidelines related to the VA DoT 763 to ensure compliance and accurate reporting.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.