Loading

Get Va Dot 760es 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA DoT 760ES online

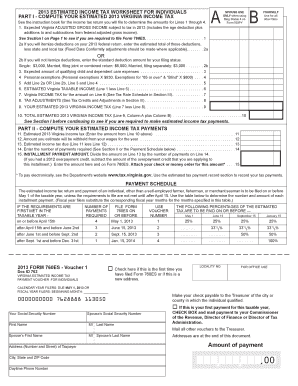

The Virginia Estimated Income Tax Payment Voucher (Form 760ES) is designed for individuals required to make estimated tax payments. This guide provides clear, step-by-step instructions for completing the form online, ensuring users navigate with confidence, regardless of their prior experience.

Follow the steps to complete the VA DoT 760ES accurately

- Press the ‘Get Form’ button to access the 760ES online form and open it in your preferred document editor.

- Begin by entering your name and Social Security number in the designated fields. Ensure that your details are accurate to prevent processing issues.

- Complete the address section with your mailing information, including city, state, and ZIP code.

- If filing jointly, include your partner's information, such as their name and Social Security number.

- Determine your expected Virginia adjusted gross income and fill it in the appropriate line, using the Estimated Income Tax Worksheet for reference.

- Calculate and enter your estimated deductions based on whether you will itemize or use the standard deduction, ensuring to adjust for any applicable credits.

- Compute your estimated taxable income and corresponding tax by following the instructions for the applicable tax rate schedule.

- Once you have calculated the total estimated income tax amount, divide it by the number of required payments to find the installment payment amount.

- Provide your payment amount in the designated field and attach a check or money order for the calculated installment amount.

- Review the completed form for accuracy, then save your changes, download a copy, or print the form for mailing.

Start completing your VA DoT 760ES online today to ensure timely tax payments.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, Virginia requires individuals to file a tax return if their income meets certain thresholds. Filing is essential not only for compliance but also to access potential refunds or credits. By using the VA DoT 760ES, you ensure your compliance and correctly report your earnings.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.