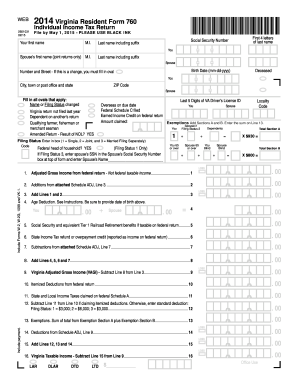

Get Va Dot 760 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign VA DoT 760 online

How to fill out and sign VA DoT 760 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Completing tax documents can turn into a major issue and severe annoyance if no suitable help is offered.

US Legal Forms was developed as an online solution for VA DoT 760 e-filing and provides numerous advantages for taxpayers.

Save, download, or export the completed form. Use US Legal Forms to guarantee a safe and simple VA DoT 760 completion.

- Obtain the template from the site in the specific section or through the Search function.

- Press the orange button to access it and wait for it to load.

- Examine the blank form and adhere to the provided instructions. If you have not filled out the form previously, follow the step-by-step guidelines.

- Focus on the highlighted fields. They are editable and require specific information to be filled in. If uncertain, refer to the instructions.

- Always sign the VA DoT 760. Utilize the included tool to create your e-signature.

- Click on the date field to automatically add the correct date.

- Review the document to make adjustments before e-filing.

- Press the Done button in the top menu once you have finished it.

How to modify Get VA DoT 760 2014: personalize forms online

Choose a reliable document editing solution you can depend on. Alter, complete, and sign Get VA DoT 760 2014 securely online.

Often, modifying forms, like Get VA DoT 760 2014, can be troublesome, especially if you acquired them online or through email but lack access to specialized software. Naturally, you can employ some alternatives to bypass it, but you risk receiving a form that won't meet submission standards. Utilizing a printer and scanner isn't a viable solution either as it consumes time and resources.

We provide a simpler and more effective method for adjusting forms. A thorough selection of document templates that are straightforward to amend and authorize, making it fillable for some users. Our platform extends well beyond just a collection of templates. One of the major advantages of utilizing our service is that you can modify Get VA DoT 760 2014 directly on our website.

As it's a web-based service, it spares you from needing to install any software. Furthermore, not all company policies permit you to install it on your work laptop. Here’s the simplest way to efficiently and safely complete your forms with our platform.

Bid farewell to paper and other unproductive methods of finalizing your Get VA DoT 760 2014 or other documents. Utilize our tool instead, which includes a vast library of ready-to-edit templates and a powerful document editing option. It’s user-friendly and secure, and can save you significant time! Don’t just take our word for it, try it out yourself!

- Click the Get Form > you'll be immediately redirected to our editor.

- Once opened, you can begin the customization process.

- Choose checkmark or circle, line, arrow, and cross along with additional options to annotate your form.

- Select the date field to insert a specific date into your template.

- Incorporate text boxes, images, notes, and more to enhance the content.

- Utilize the fillable fields option on the right to append fillable {fields.

- Choose Sign from the top toolbar to generate and add your legally-binding signature.

- Click DONE and save, print, or share the document or download it.

Get form

Related links form

When crafting a penalty abatement appeal request, include a clear explanation of why you believe the penalty should be waived. Supporting documentation, such as medical records or evidence of financial hardship, is essential. Referencing the VA DoT 760 in your appeal helps establish your case more effectively.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.