Loading

Get Va Dot 760 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA DoT 760 online

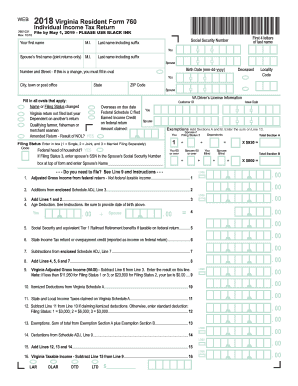

The VA DoT 760 is the form used for individual income tax returns in Virginia. Successfully completing this form online ensures accurate reporting of income and deductions, leading to a smoother tax filing experience.

Follow the steps to easily complete the VA DoT 760 online.

- Press the ‘Get Form’ button to retrieve the VA DoT 760 form and open it in your preferred online editor.

- Begin by entering your personal details in the first section. Fill in your first name, middle initial, last name, and any applicable suffix. Repeat this for your spouse if filing jointly.

- Next, provide your address details, including street number, city, and ZIP code. Ensure this information is accurate to avoid complications.

- Follow this by entering information on dependents if applicable. Include any individuals you are claiming on your tax return.

- Proceed to fill out any deductions applicable under Virginia law. Make sure to check if you are eligible for standard or itemized deductions.

- As you work through the tax calculations, make sure to enter the correct amounts on the tax lines, including any credits and payments made.

- Once you have entered all necessary information, review your entries for accuracy.

Complete your VA DoT 760 online today for an efficient tax filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, Virginia allows electronic filing of amended returns, including those filed using the VA 760C form. Filing electronically streamlines the amendment process, offering a quicker way to submit corrections and updates. Utilize platforms like uslegalforms to guide you through the electronic filing system for a seamless experience.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.