Loading

Get Ut Ustc Tc-194a 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT USTC TC-194A online

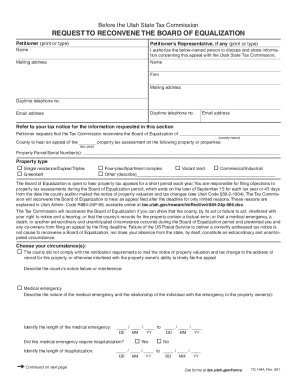

This guide provides users with clear instructions on how to complete the UT USTC TC-194A form, a request to reconvene the Board of Equalization. By following these steps, you can ensure that your appeal is submitted accurately and efficiently.

Follow the steps to successfully fill out the UT USTC TC-194A.

- Click the ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by filling out the petitioner details section. Enter your name and, if applicable, the name of your representative who is authorized to discuss the appeal with the Utah State Tax Commission.

- Provide a mailing address for both the petitioner and their representative, ensuring that you include the correct details to facilitate communication.

- Enter a daytime telephone number and email address for both the petitioner and their representative, which will be used for any follow-up regarding the appeal.

- Specify the county name for the property in question where you are requesting the Board of Equalization to reconvene.

- Fill in the property tax assessment details, including the applicable tax year and the property parcel or serial numbers.

- Select the property type from the provided options, ensuring you accurately classify your property.

- Indicate the reason for your appeal by choosing one or more of the circumstances listed. Describe the nature of your circumstances in the provided fields.

- If applicable, list any additional owners of the property and their reasons for not filing by the deadline.

- Complete the final section of the form by signing and dating it, confirming your understanding of the requirement to provide supporting documentation.

- Once you have filled out the form, save your changes, and choose to download, print, or share the completed UT USTC TC-194A form as needed.

Complete your forms online today to ensure your appeal is heard.

The minimum income amount depends on your filing status and age. In 2018, for example, the minimum for single filing status if under age 65 is $12,000. If your income is below that threshold, you generally do not need to file a federal tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.