Loading

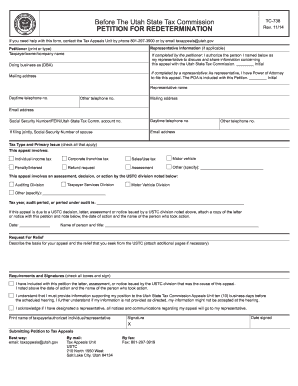

Get Ut Ustc Tc-738 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT USTC TC-738 online

The UT USTC TC-738 form is essential for taxpayers seeking a redetermination from the Utah State Tax Commission. This guide provides a clear and supportive approach to help users navigate the online filling process.

Follow the steps to successfully complete your UT USTC TC-738 form online.

- Press the ‘Get Form’ button to access the UT USTC TC-738 form and open it in your online editor.

- Begin by filling in your representative information, if applicable. Include the name, contact details, and any Power of Attorney documentation if you have authorized someone to act on your behalf.

- Next, provide your mailing address and contact information. This includes your daytime telephone number, email address, and any additional contact numbers.

- Indicate the type of tax involved and the primary issue by checking all relevant boxes such as individual income tax, corporate franchise tax, or any other specified types.

- Detail the assessment, decision, or action being appealed by specifying the appropriate USTC division. Include the tax year or period related to the appeal.

- If applicable, attach a copy of the letter or notice from the USTC and note the date and name of the official who issued the notice.

- In the request for relief section, provide a thorough explanation of the reasons for your appeal and what relief you are seeking. Consider including additional pages if necessary.

- Review the requirements and signatures section. Check all required boxes, print your name, and provide your signature. Ensure all information is accurate.

- Finally, submit your completed petition to the Tax Appeals Unit via email, print it for mailing, or fax it using the provided numbers.

Complete your UT USTC TC-738 form online today to ensure timely processing of your appeal.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Utah Form TC-40W is a form used for itemizing tax credits and adjustments for taxpayers in Utah. It relates directly to various tax considerations, including those linked to the UT USTC TC-738. Ensure you fill out this form accurately for proper processing of your state return.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.